Simplifying AMFI Monthly Mutual Fund Report: July 20203 min read

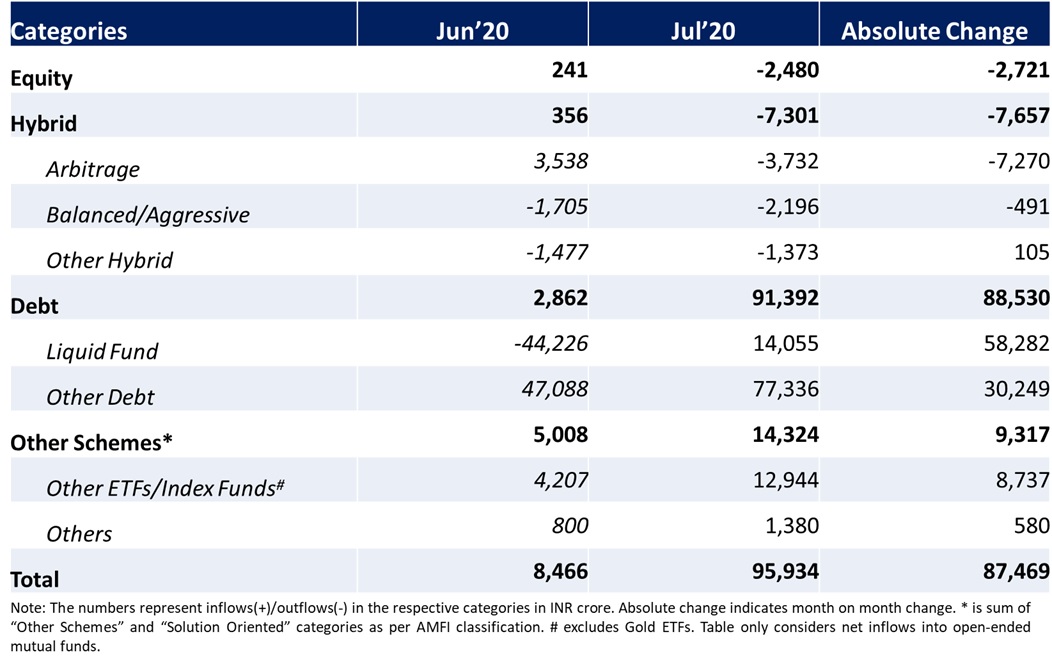

Equity markets continued its stellar performance in the month of July with equity AUM rising 5.2% to INR 7.37 lakh crore compared to the previous month. However, the category saw outflows for the first time since 2017 to the tune of INR 2,480 crore on the back of profit booking by investors. Net inflows into debt category witnessed a huge jump to INR 91,392 crore in July as institutional investors reinvested in the category after redeeming in June owing to quarter end advance tax payments. This resulted in a significant rise in the overall inflows into open ended mutual funds to INR 95,934 crore during the month. The overall industry AUM climbed 6.4% month-on-month (MoM) to come in at INR 27.11 lakh crore in July.

SIP inflows continued to remain sub INR 8,000 crore for second time in a row as investors continued to avail the SIP-pause facility provided by many asset management companies (AMCs) due to the ongoing COVID-19 crisis which impacted investor cash flows. Inflows into SIP saw a marginal 1.2% decline in July to INR 7,830 crore vis-à-vis June.

The following table shows the net inflows into various mutual fund categories in June & July 2020:

For simplicity of understanding let’s focus on the flows of open ended mutual fund categories only and highlight some salient points.

Equity

• The category witnessed outflows for the first time since 2017 with investors continuing to book profits in July as the markets delivered superior outperformance

• Apart from Focused fund and ELSS, all other equity categories witnessed outflows during the month

• HSBC AMC launched the HSBC Focused Equity Fund NFO during the month of July which garnered INR 509 crore

Debt

• With the start of a new quarter in July, debt category witnessed huge inflows of INR 91,392 crore

• Inflows into overnight and liquid category came back but was lower than usual as investors moved to little higher duration categories like Low Duration, Ultra Short, Money Market, Short Term and Corporate Bond in search of higher yields with some of these categories getting all time high net inflows

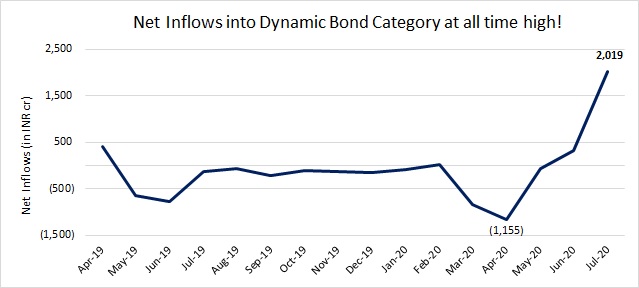

• Longer duration categories like Gilt and Dynamic Bond witnessed all time high inflows of INR 3,396 crore and INR 2,019 crore respectively as investors preferred taking interest rate risk over credit risk in their portfolios

Hybrid

• Hybrid category continued to witness outflows for 12th month in a row

• Even Arbitrage category saw outflows to the tune of INR 3,732 crore as investors moved out of the category possibly due to falling category returns

Other Schemes & Solution Oriented

• Other Schemes witnessed a huge 191% growth in net inflows MoM to INR 14,266 crore on the back of follow on offering of two tranches of the Bharat Bond ETF which ended up gathering INR 11,024 crore

• Inflows into Gold ETFs registered a 86% growth MoM to INR 921 crore as the yellow metal continued its outperformance

This is a mere factual representation of the MF industry trends and should not be considered as a buy or sell call by any means. Investors should stick to their asset allocation and continue to invest via SIP route into equities as it provides the benefit of rupee cost averaging. So, continue your SIPs according to your investment objective, investment horizon and risk profile.

Go ahead and start investing through SIP on Paytm Money. It was never simpler! Managing SIPs is seamless. Invest with as low as Rs 100 through SIP on Paytm Money!