Mutual Fund Schemes that Outperformed Others in August 20203 min read

Contents

Equity Market Snapshot

Indian equities extended their gains in the month of August 2020. Frontline indices Nifty 50 & Sensex posted gains of 2.8% and 2.7% respectively. Markets opened the month on a strong note as RBI continued its accommodative stance and announced a loan recast window to help both the banks and borrowers hit by Covid-19 related issues. Positive global cues such as a possible Russian vaccine and upbeat economic data from US & China further boosted market sentiments. Domestically, hopes of further government measures to boost the economy also helped. The last day of the month witnessed a sharp sell off as India – China border tension again flared up. Markets also were jittery as Q1FY21 GDP growth figures were set to be released wherein a sharp contraction in growth was expected.

Debt Market Snapshot

August turned out to be largely negative for the debt market. The 10Y benchmark yield rose by nearly 30 bps (100 bps = 1%) to close at 6.13%. Bond prices and yield are inversely related. The debt market was concerned that there wouldn’t be enough takers for the large central and state government borrowing program. The Monetary policy committee (MPC) minutes which highlighted inflationary pressures added to the woes of the debt market. Yields cooled towards month end as RBI announced a slew of measures such as Operation Twist, Term Repo operations and increasing the Hold to Maturity (HTM) bucket of banks to help the debt market.

Monthly outperformers

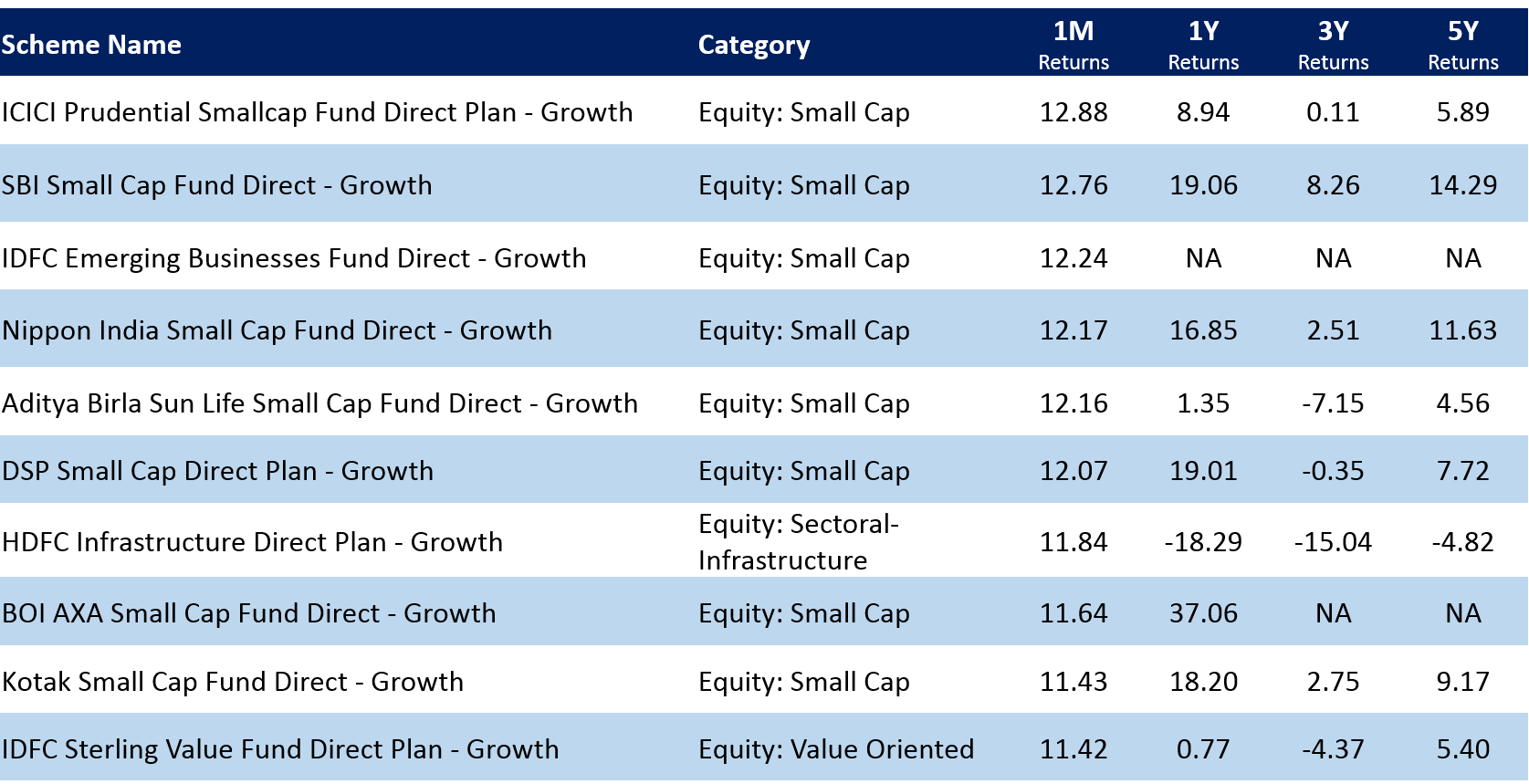

Small cap funds were the top performers in August. From a valuation standpoint, small and midcaps were attractively placed compared to their large cap counterparts. Nevertheless, this reiterates the importance of sticking to your asset allocation and not chasing after short term returns. Investors who held on to their smallcap allocations would have benefited from this up move.

Let’s take a look at the best performing mutual funds across categories in August, 2020:

Note: All the returns are in %age terms. 1 month returns are point-to-point. 1 year, 3 year, 5 year returns are annualized.

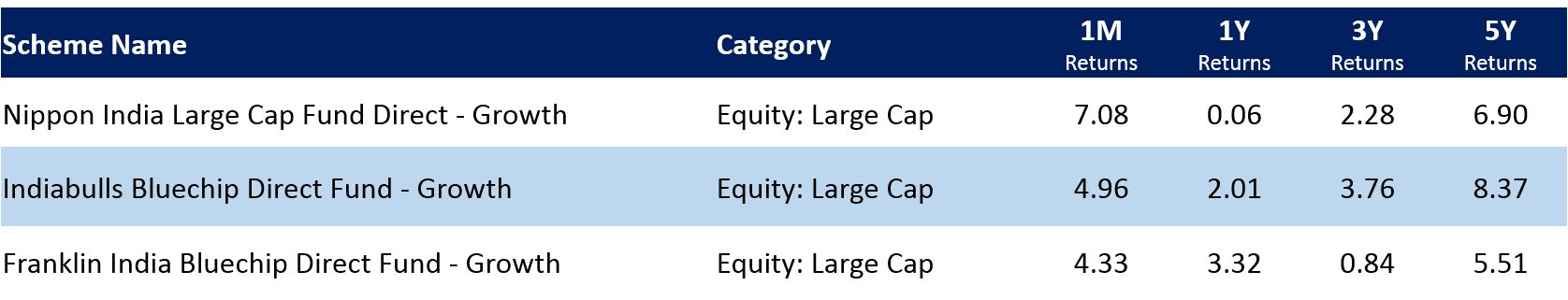

Best performing large cap funds in August, 2020:

Note: All the returns are in %age terms. 1 month returns are point-to-point. 1 year, 3 year, 5 year returns are annualized.

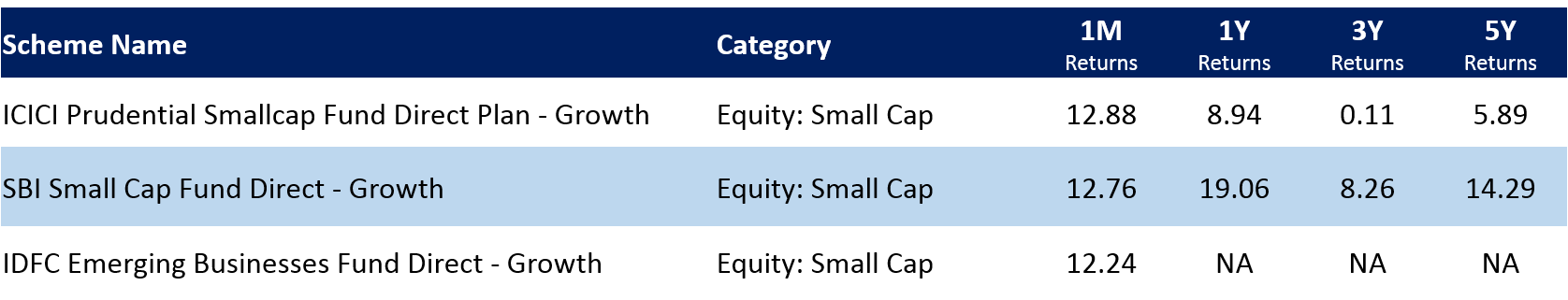

Best performing small cap funds in August, 2020:

Note: All the returns are in %age terms. 1 month returns are point-to-point. 1 year, 3 year, 5 year returns are annualized.

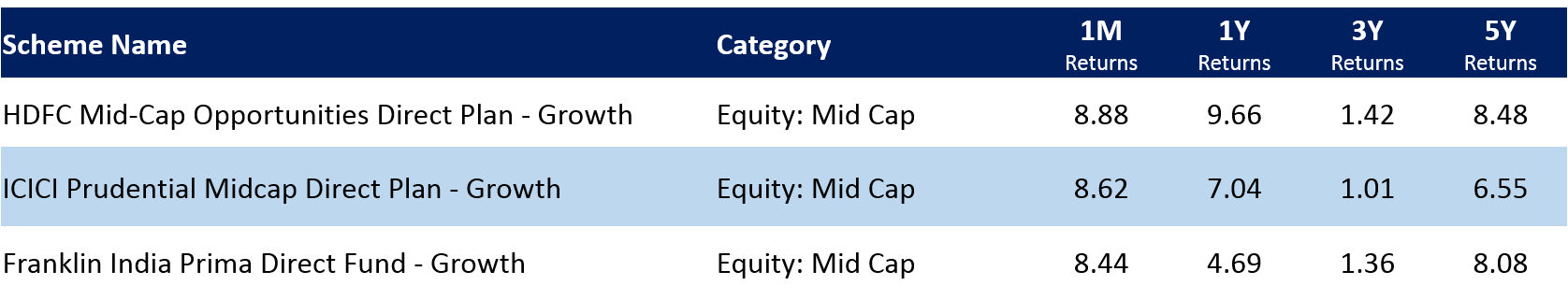

Best performing mid cap funds in August, 2020:

Note: All the returns are in %age terms. 1 month returns are point-to-point. 1 year, 3 year, 5 year returns are annualized.

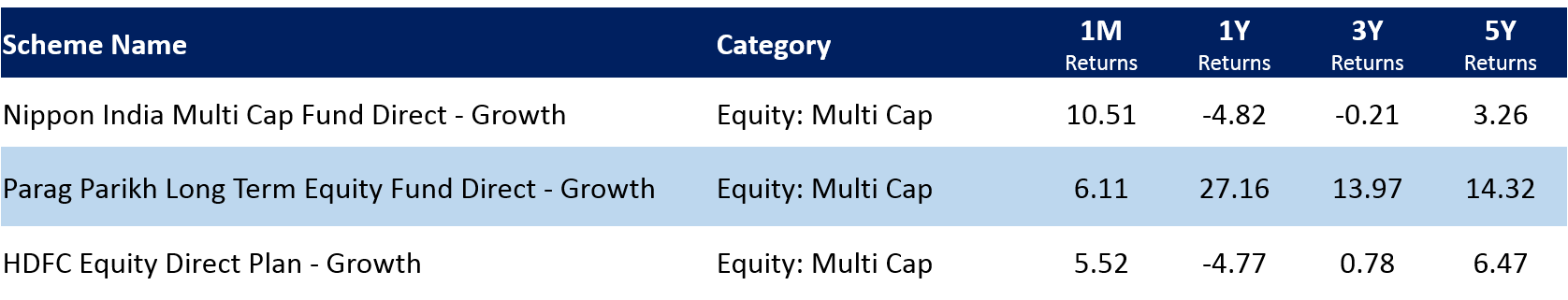

Best performing multi cap funds in August, 2020:

Note: All the returns are in %age terms. 1 month returns are point-to-point. 1 year, 3 year, 5 year returns are annualized.

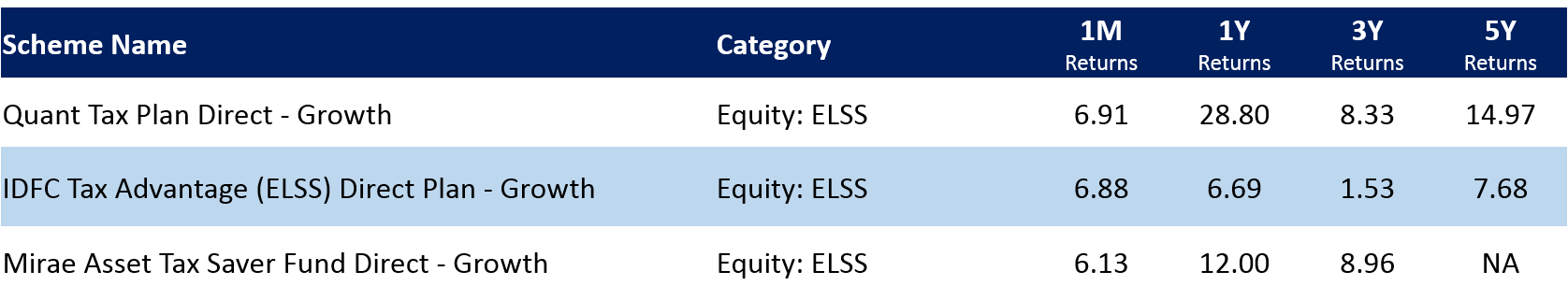

Best performing ELSS tax saver funds in August, 2020:

Note: All the returns are in %age terms. 1 month returns are point-to-point. 1 year, 3 year, 5 year returns are annualized.

What you should be doing?

Any investment decision that you make should be based on your investment objective, horizon and risk profile. This will help you remain invested in the market in spite of the volatility inherent in equity markets. Taking the SIP route will ensure that you invest in a disciplined manner while at the same time benefiting from rupee cost averaging.

Keeping all this in mind, Paytm Money has created Investment Packs, which will be a simple solution to start your investing journey.