Mutual Fund Schemes that Outperformed Others in September 20203 min read

Contents

Equity Market Snapshot

Equity markets were rocked by volatility in the month of September after a stellar performance in the earlier 3 months i.e. June to August. Markets started the month in red as first quarter data of real GDP showed a contraction for the first time in 4 decades and fiscal deficit crossed the budgeted target for the year owing to the COVID crisis. The markets gained mid-month on optimism around a COVID vaccine but sentiments were dented further owing to border tensions with China and US Fed’s statement of a slow economic recovery. Weak global cues, rising COVID cases and uncertainty around fiscal stimulus by US led the markets to end the month in red. Frontline indices Nifty 50 & Sensex marginally declined by 1.2% and 1.4% respectively.

Debt Market Snapshot

Debt market broadly remained stable during the month of September and traded sideways. The 10Y benchmark yield fell by 6 bps (100 bps = 1%) to close at 6.01%. The inflation data for August came out to be little less than expected indicating room for further rate cuts. RBI governor assured the markets that the bank will continue to maintain adequate liquidity in the markets to support growth and take further measures if necessary.

Monthly outperformers

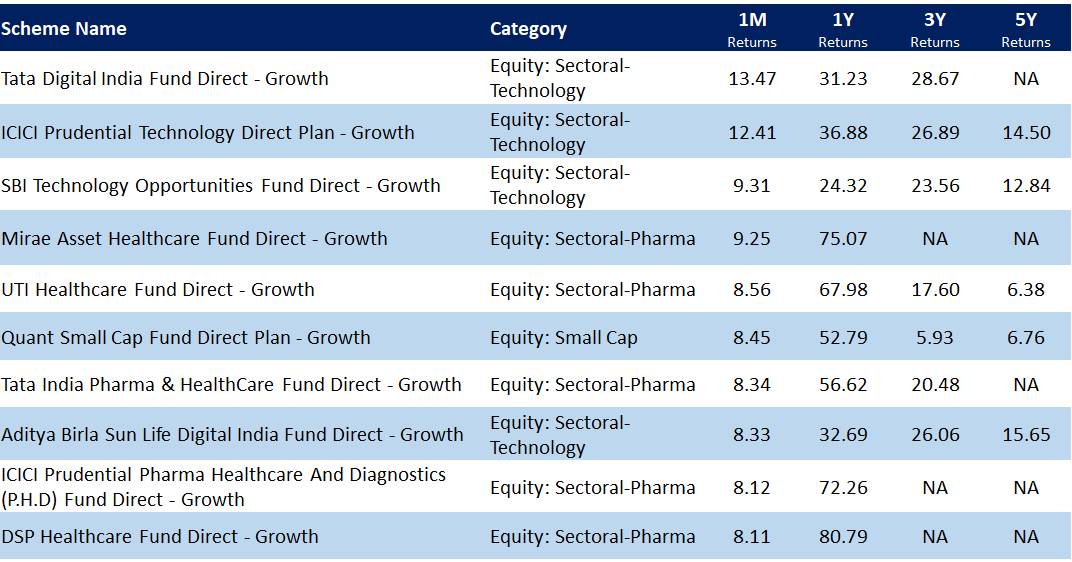

Technology and Pharma sectoral funds were the predominant outperformers in the mutual fund space in the month of September. Pharma stocks rallied after a major domestic drug maker inked a deal with Russia’s sovereign wealth fund to conduct a clinical trial and distribution of Sputnik V (COVID-19 vaccine) in India. Investors should invest into sectoral funds only if they fall into the aggressive risk profile and understand the nuances of the sector in detail.

Let’s take a look at the best performing mutual funds across categories in September, 2020:

Note: All the returns are in %age terms. 1 month returns are point-to-point. 1 year, 3 year, 5 year returns are annualized.

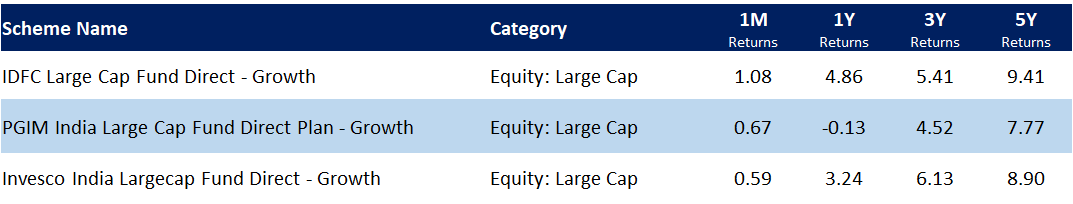

Best performing large cap funds in September, 2020:

Note: All the returns are in %age terms. 1 month returns are point-to-point. 1 year, 3 year, 5 year returns are annualized.

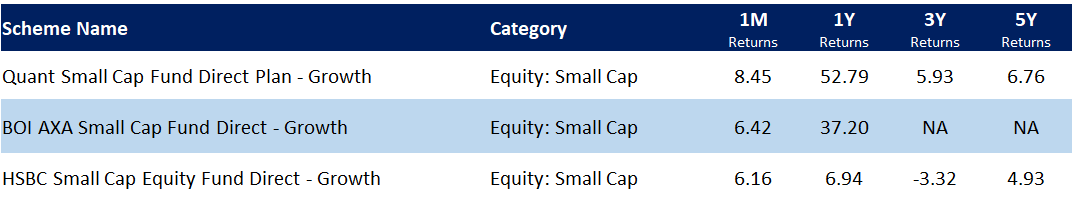

Best performing small cap funds in September, 2020:

Note: All the returns are in %age terms. 1 month returns are point-to-point. 1 year, 3 year, 5 year returns are annualized.

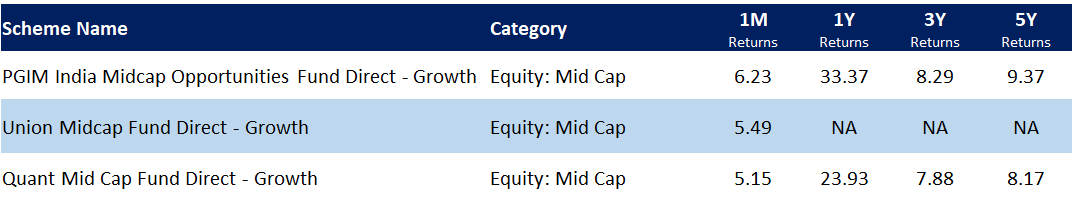

Best performing mid cap funds in September, 2020:

Note: All the returns are in %age terms. 1 month returns are point-to-point. 1 year, 3 year, 5 year returns are annualized.

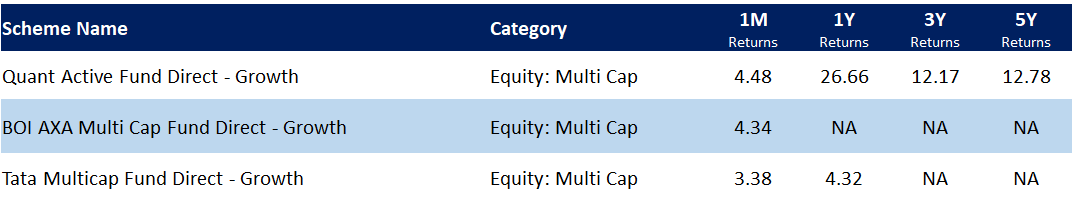

Best performing multi cap funds in September, 2020:

Note: All the returns are in %age terms. 1 month returns are point-to-point. 1 year, 3 year, 5 year returns are annualized.

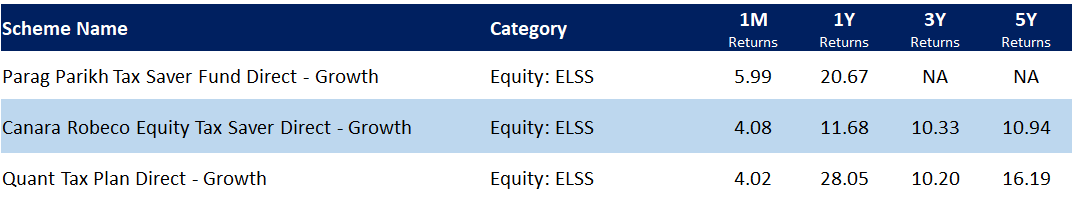

Best performing ELSS tax saver funds in September, 2020:

Note: All the returns are in %age terms. 1 month returns are point-to-point. 1 year, 3 year, 5 year returns are annualized.

What you should be doing?

Investors should stay away from sectoral funds as they are inherently very volatile and risky in nature. You are better off sticking to your asset allocation and continuing your investments through the SIP mode. Taking the SIP route will inculcate financial discipline while at the same time provide the benefit of rupee cost averaging. Make sure your investment decision is based on your objective, horizon and risk profile.

Keeping all this in mind, Paytm Money has created Investment Packs, which will be a simple solution to start your investing journey.