Summer is Not So Thanda Thanda Cool Cool For AC Makers3 min read

With a Deja vu moment, the second wave of COVID-19 hit Indian shores creating panic and lockdowns in Indian cities and towns starting April 2021.

Indian AC Makers are feeling the heat of lockdowns for the second consecutive year. The sales of air conditioners (ACs) have been hit during the peak season of April and May.

For AC manufacturers summer is the peak season. The lockdown might end in June but till then, the crucial selling season for these companies will end.

The pandemic has reportedly forced companies to recalibrate their target and go for pre-Covid (2019) sales numbers without being too aspirational.

Leading players in the segment including Voltas, Daikin, Blue Star, Panasonic, and Haier reported an almost 75% dip in April sales this year when compared with the same month of 2019 performance. Moreover, May 2021 has been a complete washout so far for them, as per the reports.

On top of the present situation, consumer sentiment has been further hit amid reports that there may be a third wave of the pandemic, which further dampens chances of a recovery in sales of compressor-based cooling products such as ACs, refrigerators, etc, as people are preferring to keep expenses on hold till the time Covid situation improves.

The Indian residential AC market is estimated to be around 7 to 7.5 million units per annum and over 15 companies compete in the segment.

What Do Companies Have To Say?

As per the media reports, company heads of Voltas, Bluestar, Daikin, Panasonic India are of the view that the second wave and subsequent restrictions have led to a recalibration of targets. Their endeavor will be to catch up with last year.

Daikin India’s head told the media that, last year, April was washed out and May was just 10% (of May 2019) and June was less than 25% of (June 2019 sales)Sales in April this year were 80% of those clocked in the corresponding month of 2019 as only the first 15 days of the month were good in terms of activities. May is looking like a complete washout and June could be 75% of 2019.

Normally, the April-June quarter contributes around 30% – 35% to overall sales of ACs and other compressors-based cooling products.

According to the Consumer Electronics and Appliances Manufacturers Association (CEAMA), the entire month of May, which is a period for peak sales of cooling products, would be almost a washout for the industry, as only 15% of the market is open and footfalls at stores are negligible.

Another Road Block – Rise In Input Costs

The input cost of AC manufacturers has increased and the overall impact of the increase in the input material is between 10 to 12%.

According to the media reports in March, the AC makers had increased the prices of ACs by 5-10%.

However, CEAMA president Nandi told the media, “Industry has to take the balance hike of 20%, they have already increased 12% so far and has to take the rest 8%. A hike will happen as things become normal. This whole impact of the price increase, disturbance and disruption would have a challenge in the second quarter also.”

The increase in input costs will ultimately shrink margins and an increase in prices may hit sales, therefore the AC industry is on a very sensitive spot.

Ek Asha Ki Kiran – Hopes For Extended Summers & Festive Season Sales

The summer season is about to end and AC makers are reportedly hoping that the extended summer season and festive season may give way to pent up demand.

According to an ET report, the Tata Group home appliances firm Voltas is pinning hopes on possible “right opportunities” going ahead like extended summer and brighter festival season to match the revenues posted in the previous two years.

It’s a Wait and Watch situation for these AC makers!

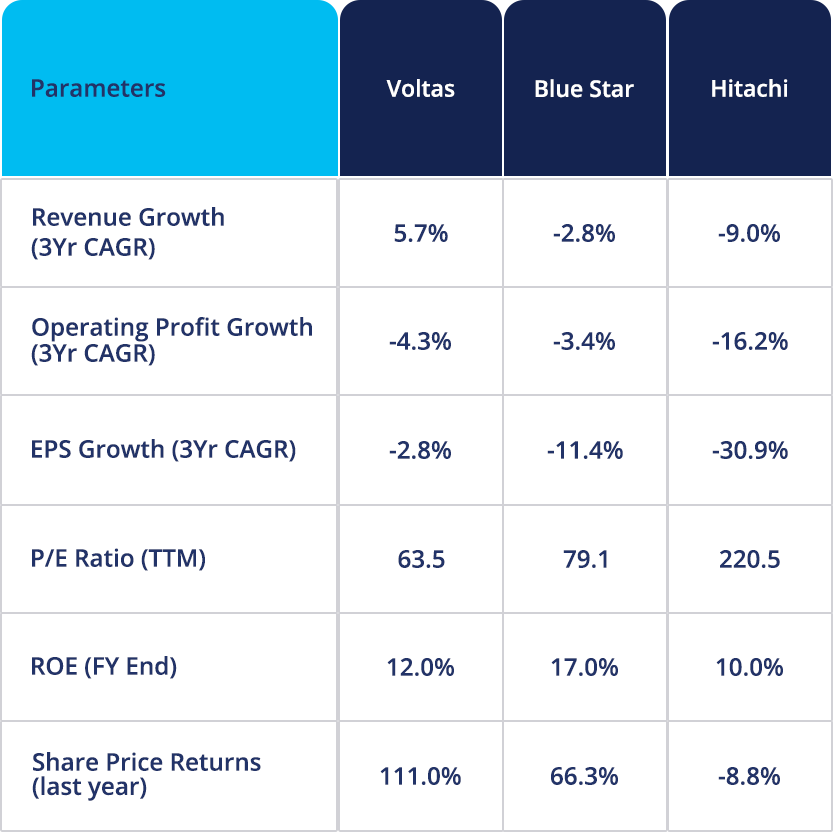

Fundamental & Technical Dose

Source – Market Data & Annual Reports

Disclaimer – This content is purely for informational purpose and in no way advice or a recommendation.