Exchange Traded Funds ( ETFs )4 min read

Exchange-traded funds (also called ETFs) are low-cost investment solutions that simply mimic an index. They are a great option for first-time investors who want to invest in stocks but find it a challenge to track the markets. With proper asset allocation, ETF investments can do wonders for your portfolio. Seems interesting…huh?

Let’s get a deeper understanding of ETFs.

Contents

What is ETF?

An ETF invests into a well-diversified basket of stocks that resemble an index like Nifty, Sensex and you can buy/sell these during market hours with an instant settlement, like the regular stocks. Also, you need to have a Demat account to trade in ETFs.

These are passively-managed schemes which means that there’s no active stock-picking by a fund manager. The idea is that the market knows best and the fund manager cannot do significant value add to the portfolio. So one is better off simply copying an index and earning market returns.

Although an ETF copies an index, its returns vary from that of the index due to the small expense charged, small cash component due to accumulated dividends, and other corporate actions. This return difference between an ETF and its underlying index is called tracking error. Generally, this is lower in an ETF compared to an index fund due to lower expenses.

Why should you invest in ETFs?

ETFs offer the benefit of passive management, low-cost, diversification, and convenience to investors as it actively trades on the exchange throughout market hours like a stock.

The expense on an ETF is much lower than its mutual fund counterparts making them one of the most inexpensive investment solutions. Owing to the numerous benefits, ETFs are increasingly becoming a popular investment option among investors.

Is liquidity important in ETFs?

As an ETF investor, another concept you should broadly understand is liquidity. This simply tells you how actively an ETF is traded in the market. Higher liquidity ensures better price discovery and easier tradability. In India, the liquidity in ETFs is not that high relative to popular stocks but it is increasing steadily. But retail investors need not worry much about liquidity as their trades can be easily executed by an authorized participant. You can think of them as an entity hired by an AMC to manage ETF liquidity in the market.

What kind of ETFs are available in India?

ETFs can be broadly classified based on the asset class they are tracking as follows:

- Equity ETFs: These primarily track an equity index like NIFTY 50, Sensex, and others. These can be further classified based on the underlying market cap like NIFTY Midcap 150 and NIFTY Smallcap. Sectoral ETFs like NIFTY Bank, NIFTY Pharma, that track a specific sector are also very popular.

- Fixed Income ETFs: These are Bond ETFs which either track a debt index like Bharat Bond ETF or simply are a collection of government bonds like Gilt ETF or repo instruments like Liquid ETF.

- Commodity ETFs: Gold ETFs are the only commodity ETFs available in India at the moment.

- World Indices: These are ETFs that track a foreign country index like the S&P 500 or NASDAQ of the USA.

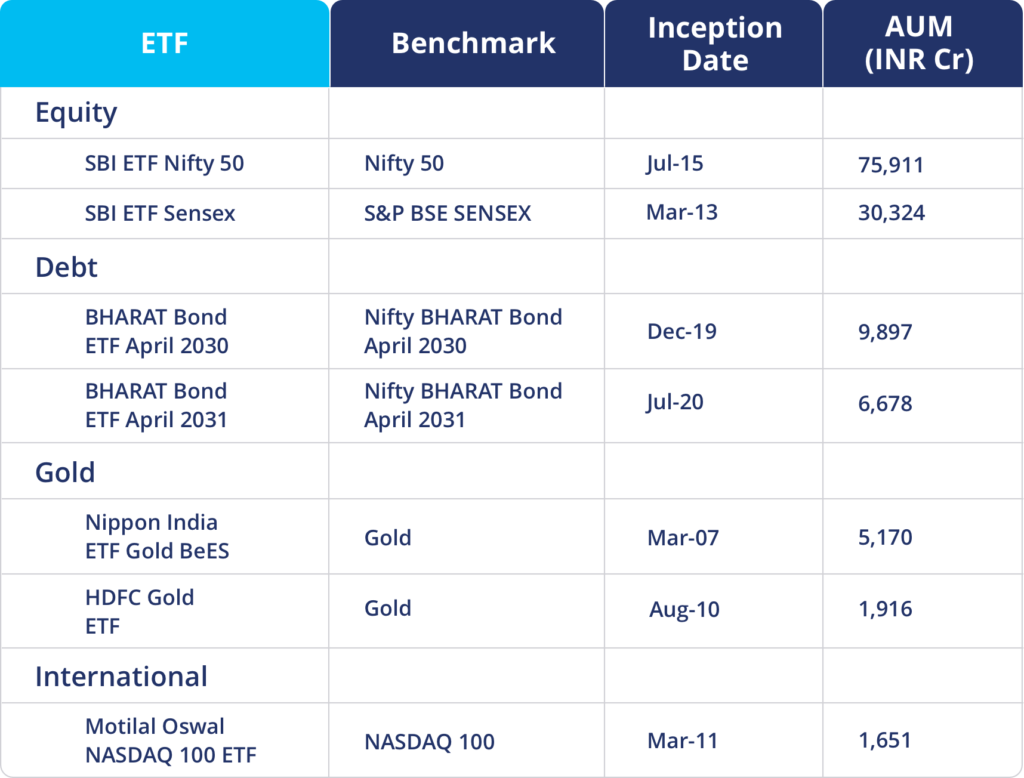

Here are a few large ETFs from different asset classes:

How to do your asset allocation using ETFs?

There is a common misconception that ETFs only track equity indices, but as mentioned earlier they track other asset classes as well. You can invest in these ETFs along with a proper asset allocation to achieve your long term financial goals.

If you are a young investor who just started your career and can take more risk with your investments, you may have high exposure to equity ETFs. Your equity allocation can be 60-70%, debt allocation can be 20-30% and allocation towards Gold and International funds can be up to a maximum of 10% each.

Your debt allocation should increase as you near the goal fulfillment. If you are in your 50s and nearing retirement, then your allocation towards equity can be 20-30%, debt allocation can be 80-90% and Gold plus International allocation should not exceed 5%.

It takes 3 simple steps to invest in ETFs on Paytm Money:

1. Download the Paytm Money App and complete your Stocks KYC within minutes.

2. Explore the ETF that you want to invest in.

3. Put the buy order during open market hours.

So what are you waiting for? Use low-cost ETFs to achieve your long term financial goals!