India Is Now Snacking More & Healthier3 min read

Dalgona coffee, banana bread and oh so many packets of chips hit us just as hard as Covid-19 in the beginning of the pandemic.

How else could people cope with the absurdity which is the pandemic? Emotional eating was on the rise! And locked up at home with endless “work-from-home” calls did not make it any better.

88% of Indians surveyed by Mondelēz International and The Harris Poll snacked more or the same during the pandemic.

But as the pandemic evolved, we got more cautious of our health. The guilt of eating took over. But eating more wasn’t the issue, eating unhealthy was the issue and thus began a conscious shift.

Clean label snacks formed 19% of total snacks launched in India from Feb 2020 to Jan 2021, compared to 11% from Jan 2016 to Jan 2017, according to a Mintel Study. “No additives or preservatives” is the most important claim in the clean labelling here.

Here are a few insights from the study conducted.

- 4 in 10 Indian consumers say their snack consumption has increased

From snacks putting us in transit between two meals, they are slowly replacing the meal altogether.

- 7 in 10 consumers say taste is more important than how healthy the snack is

The modern consumer may be health conscious but still ranks taste high up in priorities.

- But, 85% of consumers feel the need for healthy snack options

It’s time to buckle up and say no to additives and preservatives!

- Whilst hunger and energy were the key drivers for snacking pre-pandemic, now it’s a search for comfort and stress-busting benefits

COVID-19 has truly played a huge role in our shift in snacking preferences. Eating away our pain and anxiety, but in a healthy way is what the pandemic has brought about.

Big FMCG Players Had Already Jumped On That Bandwagon

Heard about the Eat Right Movement by FSSAI? This movement which started in 2018 was a push to tackle bad nutritional trends and improve overall health statistics of India.

As per an ET report, Nestlé committed to cut salt by 10%, sugar by 6% and fat by 2.5% by 2022 whereas Britannia stated that it would reduce sugar by 5% every year.

In fact, Britannia had removed transfats from all its products in 2018 and had launched 50 new products in an attempt to add healthier snacks to it’s basket.

Mayank Shah, Parle Product’s category head stated, “The trend of clean labels is catching up in India. While snack consumers are getting more health-conscious, taste still remains numero uno consideration. But a good development over last few years is that consumers are increasingly looking at labels and are avoiding nasties like preservatives and additives.”

Dabur partnered with Tetra Pak to launch it’s first low-calorie juice under the brand Real Activ as well as a 100% natural, unfiltered, unpasteurized and undiluted Apple Cider Vinegar along the same time last year.

As a direct competitor to our age-old love for Maggi, Marico forayed into instant noodles with Saffola Oodles, with the packaging bolding out “NO MAIDA.”

And if a market is roaring, would it be wise to say smaller players won’t want a bite of it?

New-age Players Biting Into The Market Share

So many startups have ventured into the snacking space to satisfy all sorts of cravings of consumers.

Hungry Foal, Slurrp Farm, The Green Snack Co & Milk Lane are just a few examples. From protein bars to millet-based snacks to pre-biotic chocolates, we have everything on the shelves these days.

But hey, can we really have too much of food in the world?

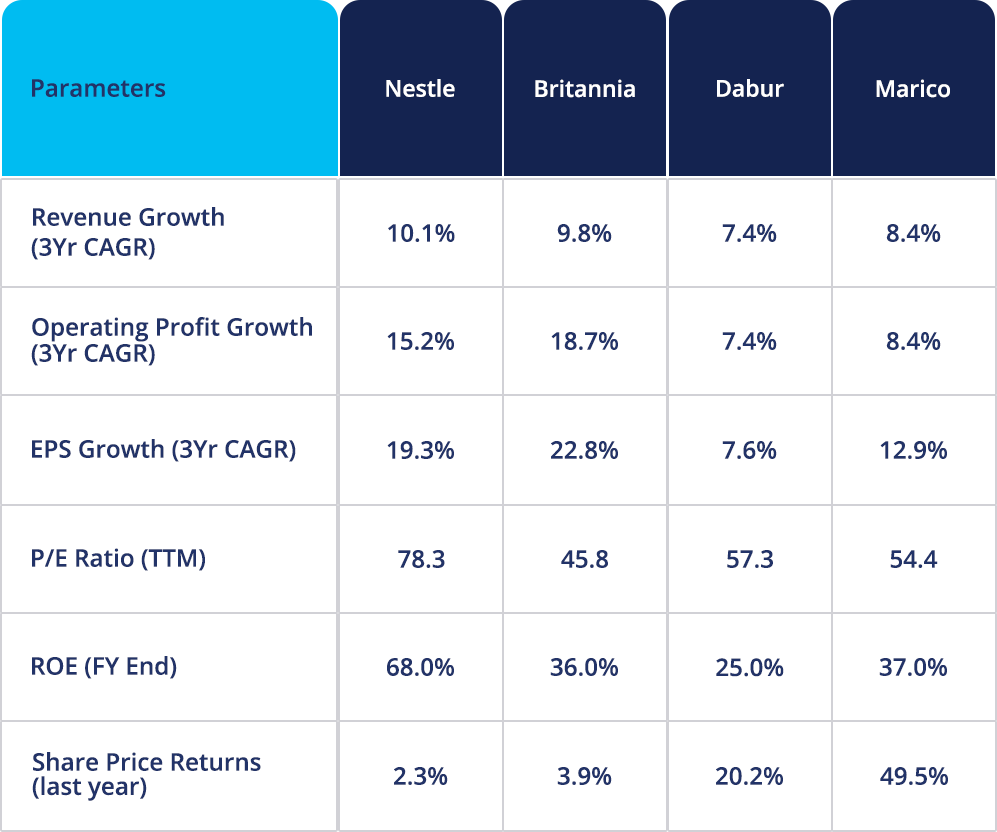

Let’s check out a few metrics of these leading FMCG brands.

Fundamental Dose

Source – Market Data & Annual Reports

Disclaimer – This content is purely for informational purpose and in no way advice or a recommendation.