Introducing Slab-Based MTF Pricing: Low Rates, Smarter Trades3 min read

At Paytm Money, we’re all about helping you trade better, smarter, and more cost-effectively. That’s why we’re introducing a flexible, slab based pricing model for Margin Trading Facility (MTF), also know as Pay Later, – designed to reward you with lower interest rates and a more transparent brokerage structure.

Let’s break it down.

What’s New?

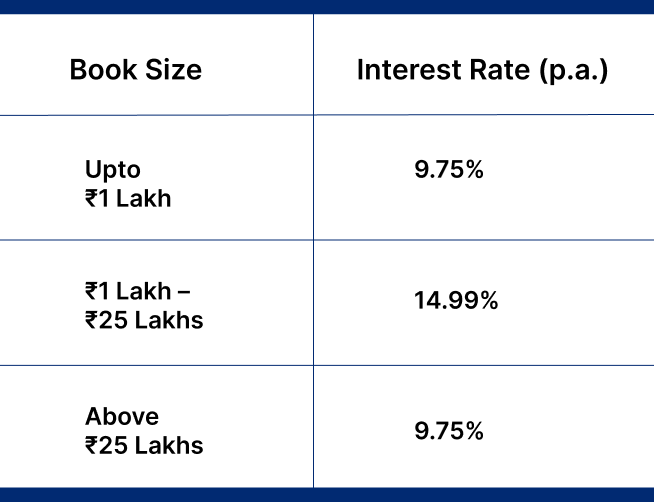

1. Slab-Based Interest Rates (Based on Your MTF Usage):

Tailored rates for every Trader

So whether you are new to trading or managing large volumes, we have a rate that suits your needs and maximises your advantage.

2. Smarter Brokerage Calculation:

We’re simplifying brokerage too!

It’s now 0.1% of your trade value for MTF orders above Rs 20,000.

For orders below Rs 20,000 the brokerage will be calculated based on the existing brokerage, upto Rs 20.

That means more clarity and fairness across all your trades.

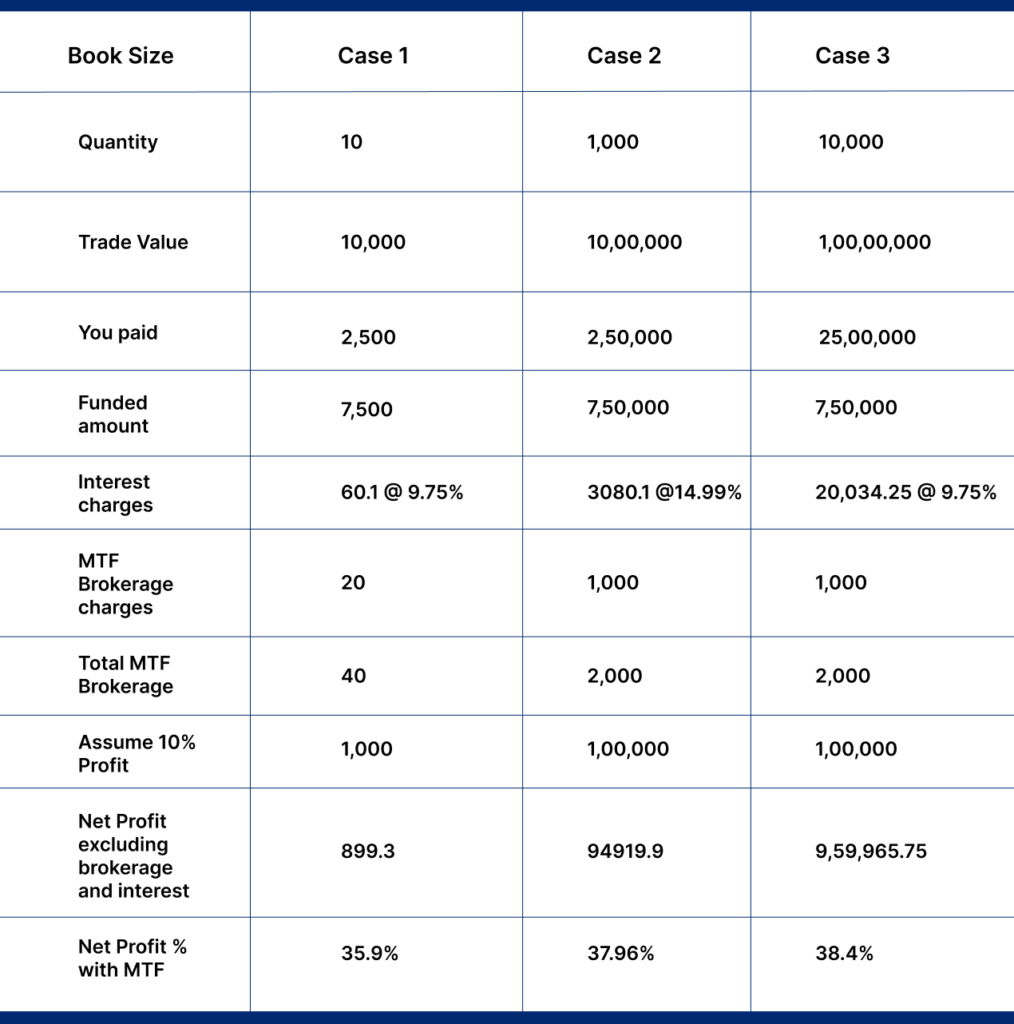

Let’s break it down with Examples:

Let’s assume you are trading a stock called XYZ, currently priced at Rs. 1,000.

Case 1: You bought 10 quantities of the stock

Trade value = Rs 10,000

You paid Rs 2,500 (assuming 4x leverage)

Funded amount = Rs 7,500

Charges

- Interest charges for 30 days @ 9.75% = Rs 60.1

- Brokerage charges = Rs 20 (2.5% of trade value upto Rs 20)

- Total brokerage charges for 1 buy and 1 sell trade = Rs 40

If the stock rises to Rs 1100 (10% increase), then profit = 1,000

Net profit excluding brokerage and interest charges = 1000-40-60.1= 899.3

Net profit % with MTF = 899.3 / 2500 = 35.9%

Case 2: You bought 1000 quantities of the stock.

Trade value = Rs 10,00,000

You paid Rs 2,50,000 (assuming 4x leverage)

Funded amount = Rs 7,50,000

Charges

- Interest charges for 10 days @ 14.99% = Rs 3,080.1

- Brokerage charges = Rs 1,000 (0.1% of trade value)

- Total brokerage charges for 1 buy and 1 sell trade = Rs 2,000

If the stock rises to Rs 1100 ( 10% increase), then profit = 1,00,000

Net profit excluding brokerage and interest charges = 100000-2000-3080.1= 94919.9

Net profit % with MTF = 94,919.9 / 2,50,000 = 37.96%

Case 3: You bought 10,000 quantities of the stock

Trade value = Rs 1,00,00,000

You paid Rs 25,00,000 (assuming 4x leverage)

Funded amount = Rs 75,00,000

Charges

- Interest charges for 10 days @ 9.75% = Rs 20,034.25

- Brokerage charges = Rs 10,000 (0.1% of trade value)

- Total brokerage charges for 1 buy and 1 sell trade = Rs 20,000

If the stock rises to Rs 1100 ( 10% increase), then profit = 10,00,000

Net profit excluding brokerage and interest charges = 10,00,000-20,000-20,034.25= 959965.75

Net profit % with MTF = 9,59,965.75 / 25,00,000 = 38.4%

Refer the chart below to compare:

Why This Change?

Until now, all MTF users were charged a flat 11.99% p.a., and brokerage was ₹20 or 2.5% of trade value (whichever was lower). But we understand one size doesn’t fit all.

This upgrade achieves two key goals:

- Rewards high-value and frequent traders with better pricing.

- Encourages new users to explore MTF with a low entry-point rate, making it easier for beginners to explore MTF.

Benefits You’ll Love

Pay Less for Leverage

Reduced costs give you greater flexibility and improved control over your trades.

Tailored for All

From beginners to high-value traders, the new rates reward every level of engagement.

Smarter Use of Capital

With MTF, buy stocks by paying just a fraction upfront and fund the rest affordably.

Ready to Make the Most of MTF?

Whether you’re a new investor trying out MTF or a seasoned trader with a large portfolio, this feature ensures you’re always getting a good deal.

Disclaimer: Investments in the securities market are subject to market risks, read all the related documents carefully before investing. Brokerage will not exceed the SEBI prescribed limit.This content is purely for information purpose only and in no way to be considered as an advice or recommendation. MTF is subject to provisions of SEBI circular CIR/MRD/DP/54/2017 dated June 13,2017 and the terms and conditions mentioned in the rights and obligations statement issued by Paytm Money Limited. Paytm Money Ltd SEBI Reg No. Broking – INZ000240532, Depository Participant – IN – DP – 416 – 2019, Depository Participant Number: CDSL – 12088800, NSE (90165), BSE (6707) Regd Office: 136, 1st Floor, Devika Tower, Nehru Place, Delhi – 110019. For complete Terms & Conditions and Disclaimers visit: https://www.paytmmoney.com