What’s So Great About The Greeks?3 min read

Delta, Gamma, Theta, Vega & Rho, a.k.a the most common option Greeks, are an important tool for option traders.

Option Greeks measure the different factors that affect the price of an option contract. These measures are highly instrumental in making informed decisions in options trading.

We will be walking through the mechanics of each of these 5 popular Greeks.

Delta (Δ)

How much does the price of an option change as the price of the underlying changes? Delta answers this question.

Delta ranges from -1 to 1. Call options range from 0 to 1 whereas puts range from -1 to 0. This means that calls have a positive relationship with delta whereas puts have a negative.

Think about it. If the price of a stock rises, who would be happier? A call buyer, obviously. Hence, the price of a call option rises with the price of the underlying.

Delta is also known as a hedge ratio. If a trader knows the delta of the option, he can hedge his position by buying or shorting the number of underlying assets multiplied by delta.

Gamma (Γ)

Gamma measures the sensitivity of Delta relative to the change of the price of the underlying. In simpler words, it tells you how much Delta changes with a Rs. 1 change in the underlying price.

Both long call and long put have a positive gamma and option has a maximum gamma when it is at-the-money.

Theta (Θ)

Options have a finite life and their price change as they approach the end of their life, i.e. expiration. Theta measures how much value gets eroded as an option nears expiration. This is also called time decay of an option.

Theta is usually a negative number as the option loses value over time. Time decay is always a boon for the seller as there are lesser chances of the buyer making money and more chances of the option expiring worthless.

Vega (v)

The big V – Volatility – plays a major role in the price of the option. So here, Vega measures how the price of the option changes with a 1% change in volatility of the underlying.

An increase in Vega corresponds to an increase in the option value of both calls and puts.

Rho (p)

Last but not the least, we have interest rates. The rho might be the least important among the lot as options are less sensitive to interest rate changes thanto the others mentioned above.

Calls have a positive relationship with interest rates whilst puts have a negative relationship.

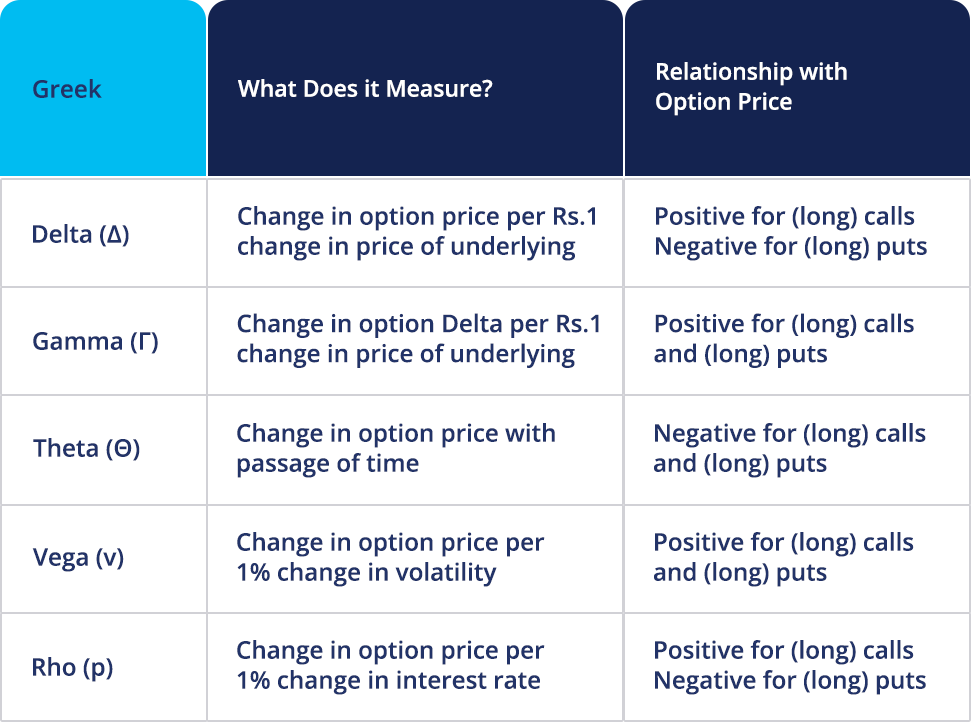

Here’s a summary of what we have spoken about so far.

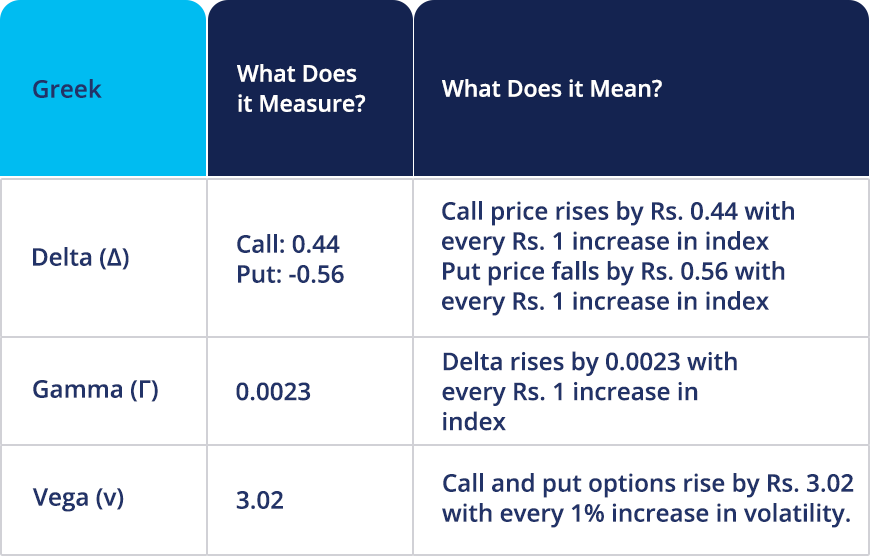

Let’s look at the call and put Greeks for Nifty 14150.

*Calculated as on May 5, 2021

And now, onto the importance of these.

How Are The Greeks Useful?

Here’s how:

- Understand the likelihood of the option expiring in the money with Delta.

- Calculate how Delta would change with the change in stock price with Gamma.

- Gauge how much the value of an option reduces as expiration comes close with Theta.

- Analyze the effect of volatility on the price of the option with Vega.

- Evaluate how the price of the option changes with an increase of decrease in interest rate with Rho.

- Greeks help traders eliminate the guesswork out of options trading and make calculated, informed decisions.

Disclaimer –

This content is purely for information and investor awareness purpose only and in no way an advice or recommendation. You should independently research and verify the information you find on our website/application. The securities quoted are exemplary and are not recommendatory. Investment in securities market are subject to market risks, read all the related documents carefully before investing. Paytm Money Ltd SEBI Reg No. Broking – INZ000240532. NSE (90165), BSE(6707) Regd Office: 136, 1st Floor, Devika Tower, Nehru Place, Delhi – 110019.