10 Upcoming IPOs | Companies That Have Received SEBI’s Approval5 min read

IPOs are the way to get in on the action early. Early bird offer, if you may?

It’s going to be raining IPOs and staying on top of upcoming IPOs is a definite checklist item for all investors. So, we bring to you the 10 upcoming IPOs.

After EaseMyTrip, Indigo Paints & Nazara Technologies among others debuted on the bourses with a big bang this year, other companies have started queuing up too.

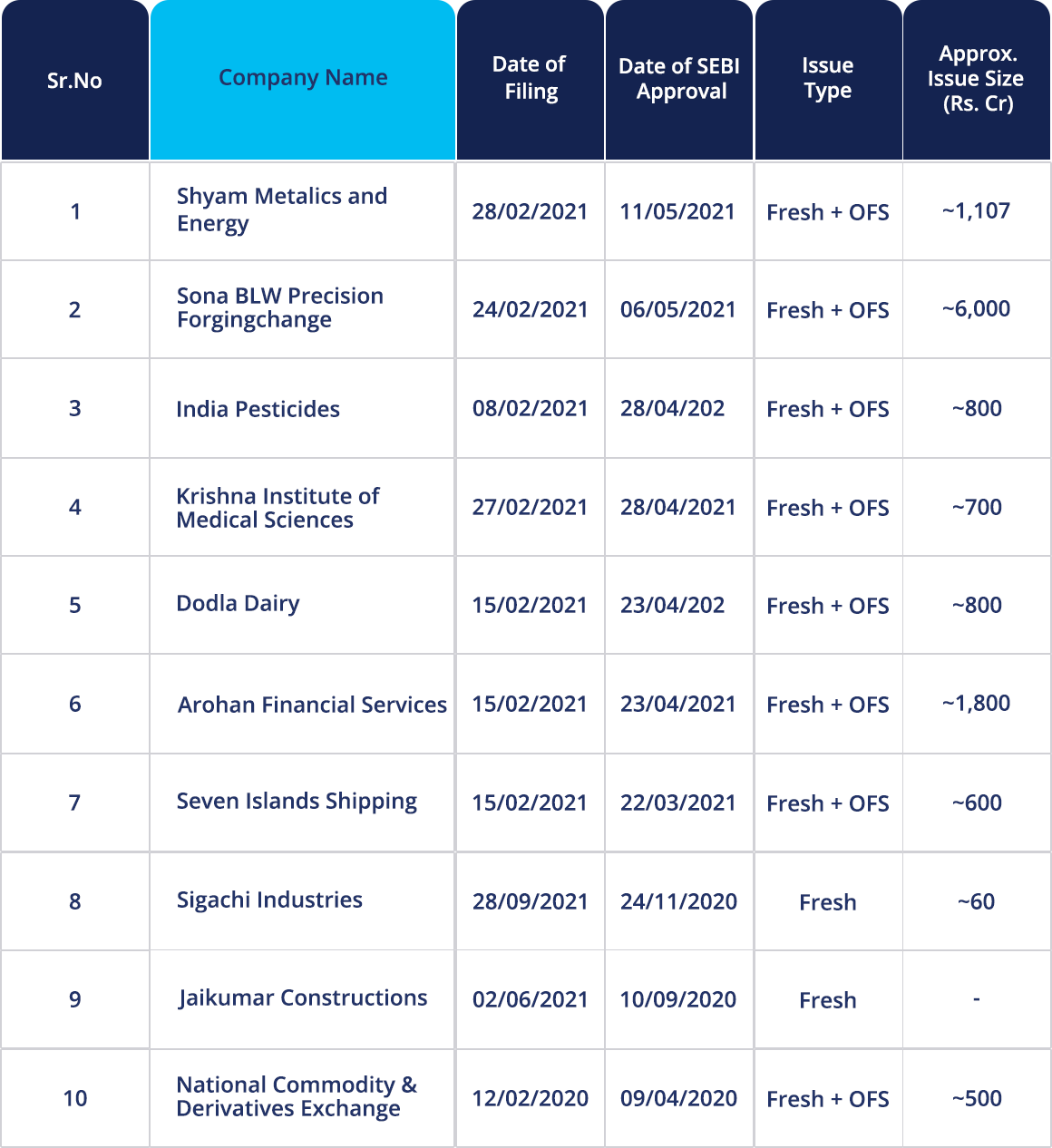

Let’s take a look at the companies that have filed their Draft Red Herring Prospectus (DRHP) and received approval from market regulator, SEBI.

List Of Companies With SEBI’s Approval

Source – Axis Capital IPO Diary, IPO Central, multiple news articles

Let’s check out the detailed functioning and operations of the companies along with their objective of the offer.

1. Shyam Metalics and Energy

Based in Kolkata, the company focuses on long steel products and ferroalloy. It is present across the steel value chain with institutional and end-use customers.

As of March 31, 2020, it was one of the leading players from the pellet capacity angle and the 4th largest player in terms of sponge iron capacity in India. With 42 distributors and brokers across 13 states & 1 union territory, it is all set to dive into the public ocean.

The IPO comprises fresh issuance of equity shares worth up to Rs. 657 Cr and an offer for sale of Rs. 450 Cr by existing shareholders.

Objectives of the offer:

- Repayment of borrowings

- General corporate purposes

2. Sona BLW Precision Forging (Sona Comstar)

Sona Comstar is a Gurugram based auto component maker with clients across US, Europe, India and China. It boasts of being one of the two largest exporters of starter motors in the country.

It has 9 manufacturing and assembly facilities across India, China, Mexico and USA, of which 6 are located in India. Did we mention it is also the largest manufacturer of differential gears for passenger vehicles, commercial vehicles and tractors in India?

The IPO comprises fresh issuance of equity shares worth up to Rs. 300 Cr and an offer for sale of Rs. 5,700 Cr by existing shareholders.

Objectives of the offer:

- Repayment of borrowings

- General corporate purposes

3. India Pesticides

This Lucknow-based agrochemical firm is the sole Indian manufacturer and among top 5 global manufacturers for several technical products, such as, Folpet, Thiocarbamate Herbicide & Cymoxanil which are used to make fungicides.

The IPO comprises fresh issuance of equity shares worth up to Rs. 100 Cr and an offer for sale of Rs. 700 Cr by existing shareholders.

Objective of the offer:

- Working capital requirements

4. Krishna Institute of Medical Sciences

KIMS is one of the largest corporate healthcare groups, in AP and Telangana in terms of number of patients treated and treatments offered. The treatments range over 25 specialties and super specialties, cardiac sciences, orthopaedics, mother and child care, gastric sciences, organ transplantation etc.

The IPO comprises fresh issuance of equity shares worth up to Rs. 200 Cr and an offer for sale up to 21,340,931 equity shares.

Objective of the offer:

- Repayment of borrowings

5. Dodla Dairy

Known for it’s branded milk and dairy based Value Added Products (VAPs), this company operates primarily across the 5 Indian states of Andhra Pradesh, Telangana, Karnataka, Tamil Nadu and Maharashtra along with a presence in Uganda and Kenya.

With 13 processing plants across India and has 254 dairy farms, it also manufactures and sells cattle feed to farmers through the procurement network.

The IPO comprises fresh issuance of equity shares worth up to Rs. 50 Cr and an offer for sale up to 10,085,444 equity shares by existing shareholders.

Objectives of the offer:

- Repayment of borrowings

- Funding capital expenditure requirements

6. Arohan Financial Services

This is one of the well-known NBFC-MFI with operations in financially under-penetrated Low Income States of India which provides income generating loans and other financial inclusion related products to customers with limited or no access to financial services.

Having 2.21 million borrowers across 17 states, it was the biggest NBFC-MFI in Eastern India and the 5th largest NBFC-MFI in India based on GLP as of September 30, 2020.

The IPO comprises fresh issuance of equity shares worth up to Rs. 850 Cr and an offer for sale up to 27,055,893 equity shares by existing shareholders.

Objective of the offer:

- Funding future capital requirements

7. Seven Islands Shipping

It is the 3rd largest seaborne logistics company in India by deadweight tonnage with a presence in the liquid products trade where liquid products like white oils, black oils, lube oil and liquid chemicals. It transports these through its 20 registered and flagged liquid cargo vessels.

The IPO comprises fresh issuance of equity shares worth up to Rs. 400 Cr and an offer for sale up to Rs. 200 Cr.

Objective of the offer:

- Acquisition of 1 large crude carrier vessel and 1 medium-range vessel

8. Sigachi Industries

This 3 decade old company is among the top 10 global excipient-makers and also manufactures microcrystalline cellulose (MCC) which is used in finished dosages by pharma players.

The IPO comprises a fresh issuance to the tune of Rs. 60 Cr.

Objective of the offer:

- Expansion of MCC production facilities at Dahej and Jhagadia in Gujarat

- General corporate purpose

9. Jaikumar Constructions

This real estate developer has been involved in integrated architecture, procurement, and construction services.

The IPO comprises a fresh issuance of upto 79,00,000 equity shares.

Objective of the offer:

- Development of phase 1 of residential project Parksyde Nest in Nashik

- Investment in subsidiary for part-financing the construction of “Parksyde Business Avenue”

- Repayment of borrowings

- General corporate expenses

10. National Commodity & Derivatives Exchange

When one thinks of commodity exchange in India, one only thinks of NCDEX.

National Commodity & Derivatives Exchange Limited (“Exchange”) is the leading agricultural commodity exchange in India with the following 4 business verticals:

- Futures and options trading

- Clearing and settlement of trades through National Commodity Clearing Limited (NCCL)

- Online commodities spot market, through NCDEX e-Markets Limited (NeML)

- Issuance of electronic negotiable warehouse receipts for commodities through National E-Repository Limited (NERL)

The NSE holds a 15% stake in NCDEX; Nabard and LIC at 11.10% each; FFCO and Oman India Joint Investment Fund at 10% each; and Punjab National Bank 7.29%.

The IPO comprises fresh issuance of equity shares worth up to Rs. 100 Cr and an offer for sale up to 14,453,774 equity shares by existing shareholders.

Objective of the offer:

- Funds to be directed towards the Core Settlement Guarantee Fund (SGF)

- Net worth requirements of NCCL

Disclaimer – This content is purely for informational purpose and in no way advice or a recommendation.