TCS Claims the Crown of Largest IT Co in the World, Dethrones Accenture3 min read

Information Technology companies had a relatively smoother ride in the pandemic as the business continued with the “Work From Home” model. Orders were pouring in for IT companies even during the lockdown.

The IT industry is reportedly cracking huge deals and the client’s preparedness to spend on cloud computing, artificial intelligence, and the internet of things managed to retain the revenue streams IT.

India’s largest software bellwether, Tata Consultancy Services, on Monday dethroned Accenture to become the most valued information technology company in the world.

Tata Consultancy Services is the software arm of Indian conglomerate Tata Group and is also the largest private-sector employer with a reported headcount of over 448,000 employees, with nearly one-third of them women.

The share price of the most precious jewel of Tata Group rose 1.26% intraday to a record high of Rs. 3,345.25 rupees on Jan 25th on the BSE, taking its market capitalisation to an all-time high of $169.3 billion. Whereas, Accenture was valued at $165.7 billion after it plunged 1.6% on Monday, Jan 25 on the New York Stock Exchange.

In the process, TCS also became India’s most valuable company, overtaking Reliance Industries after almost 11 months.

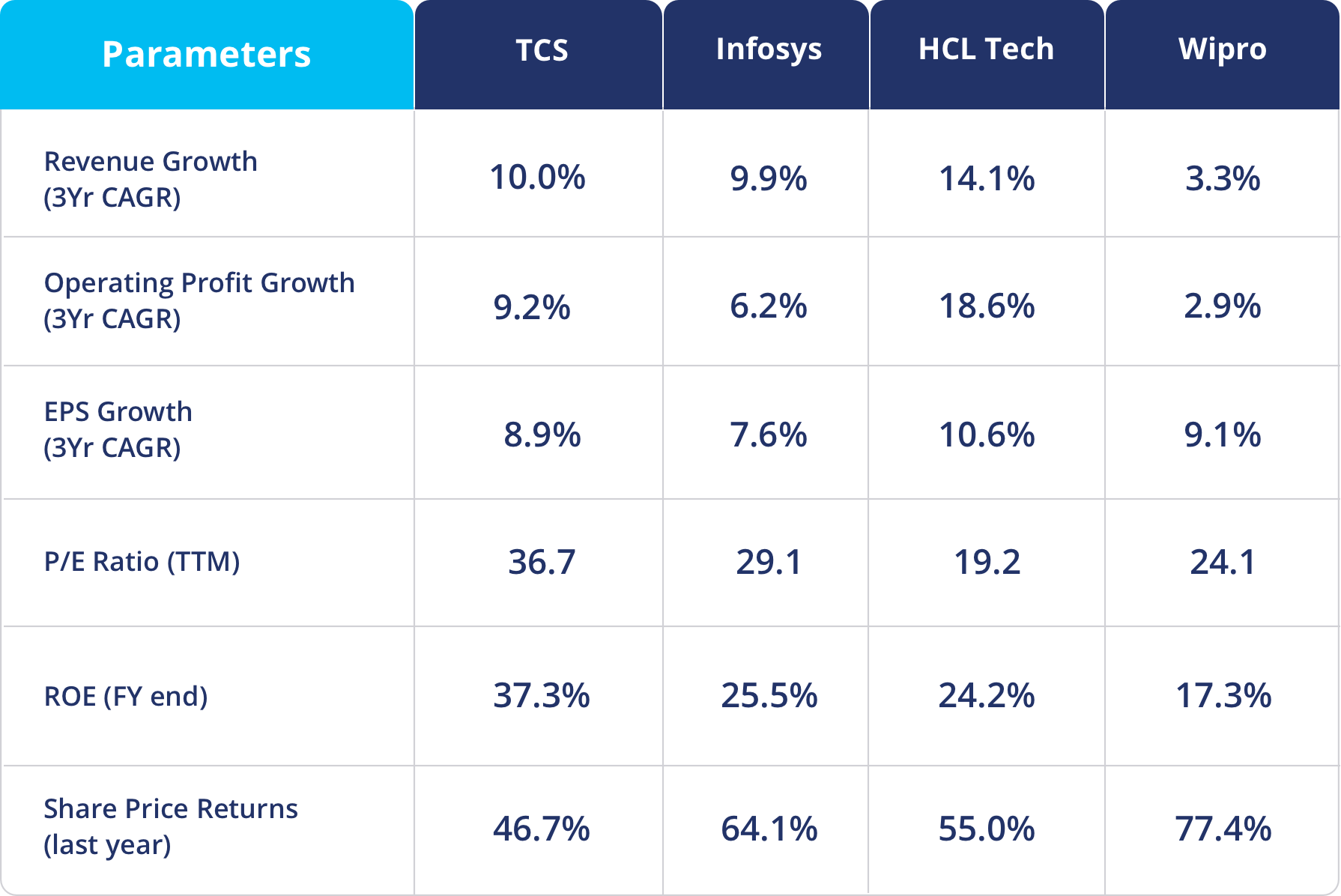

If we look at other information technology giants in the world, IBM’s market cap stands at $105 billion, followed by Infosys – $77 billion, Cognizant – $42 billion, HCL Technologies – $35 billion, and Wipro – $33 billion.

Walking Like a Boss in a Weak Quarter

Shares of Tata Consultancy Services were on an uphill hike because of better than expected results in the third quarter i.e Oct-Dec, which is generally considered a seasonally weak quarter.

TCS delivered better-than-expected Oct-Dec results, the company’s revenue and net profit increased by 5.4% and 7.2% on year to Rs 42,015 crore and Rs 8,701 crore, respectively.

On a constant currency basis, the company’s revenue growth was 4.1% as compared to the previous quarter and 0.4% on year.

TCS’s revenue in the Oct-Dec quarter was on the back of ramp-up in large deals. The revenue growth was led by the banking and financial services vertical, which grew 2% and 2.4% on quarter and on year, respectively, on a constant currency basis. The segment contributes nearly 30% to the company’s revenue.

TCS’s North America market, which contributes about half its revenue, saw 3.3% on quarter growth. The company’s earnings before interest, depreciation, tax, and amortisation (EBITDA), or operating profit, for the quarter, was Rs 11,184 crore, an increase of 12.1% on year. Operating profit margins in the Oct-Dec quarter stood at 26.6%, a rise of 160 basis points year on year.

As per media reports, the company took a salary hike in October and it was able to offset the costs due to operational efficiencies resulting in margin improvement. A reduction in travel spends and sub-contracting costs, too, are believed to have helped the company.

The performance was driven by strong growth in all its key business segments and geographies. The company bagged $6.8 billion worth of contracts in the Oct-Dec quarter.

Deals in Pipeline

As per media reports, during Oct-Dec, the IT bellwether made two acquisitions to expand its presence in the European market and is likely to see more large deal wins, according to management.

It bagged a big deal from Prudential Financial and its total contract value for the December quarter was $6.8 billion. The company announced a salary hike in October and to execute the new deals it had ramped up the hiring of freshers and experienced job seekers.

Way Forward

TCS is confident about getting back on to a double-digit growth trajectory in FY22 as it anticipates a multi-year technology transformation cycle.

The announcement in a seasonally weak quarter was a surprise as the company usually refrains from giving any guidance.

The company last witnessed double-digit sales growth on a year-on-year (YoY) in the June 2019 quarter.

TCS CEO Rajesh Gopinathan reportedly said that “We are entering the new year on an optimistic note. Our market position stronger than ever before, and our confidence reinforced by the continued strength in our order book and deal pipeline.”

Technical & Fundamental Dose