How to transfer existing Stocks to your Paytm Money account?5 min read

If you currently have stocks in your old broker account and want to transfer these stocks to your Paytm money account, you need to follow the below steps. When you open a new Paytm money trading account, you get a new Demat account. The below process involves transferring these holdings from the old Demat account to the Paytm money Demat account.

Transfer holdings are a one-time activity that needs to be done in order to track all stocks in the Paytm money app or website. The process of transferring holdings varies depending on your existing broker. Few brokers allow online transferring of holdings via CDSL easiest and others follow an offline process of submitting DIS (Delivery Instruction Slip). Please check with your previous broker on the exact process supported by them for transferring Holdings.

NOTE: Please transfer only Stocks / ETFs / SGBs / REITs. We recommend that you do not transfer your existing mutual funds holdings (if any) to the Paytm money Demat account. You won’t be able to track MFs in Demat under Paytm money Stocks Portfolio.

Online method (via CDSL Easiest Website)

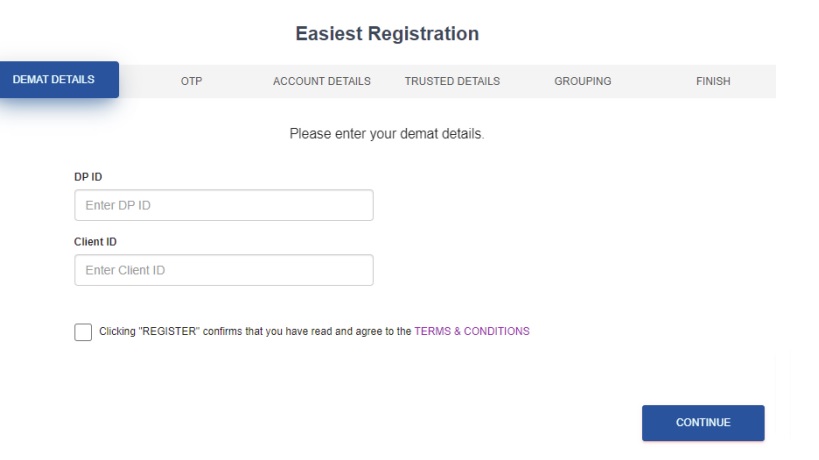

If your broker allows the CDSL Easiest mode of transferring holdings, you can use the below process. Many online brokers like Zerodha support this mode. In order to transfer the shares from a different broker’s DEMAT account to Paytm Money’s DEMAT account, you have to sign up for CDSL easiest. Follow the below steps to register.

- Open the Easiest Registration portal.

- Enter both 8 digits DP ID and the Client ID. Depository ID is the identification number of the depository participant member i.e. Broker and click continue.

- Demat Account Number or BO ID (Beneficiary Owner Identification Number) is a 16-digit number. The first 8 digits are the DP ID and the rest 8 digits are the Client ID.

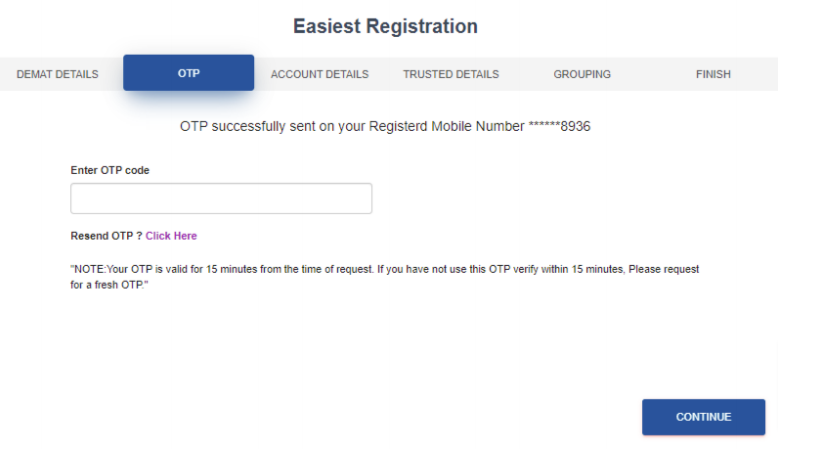

- You will receive an OTP to your registered number after you click on continue.

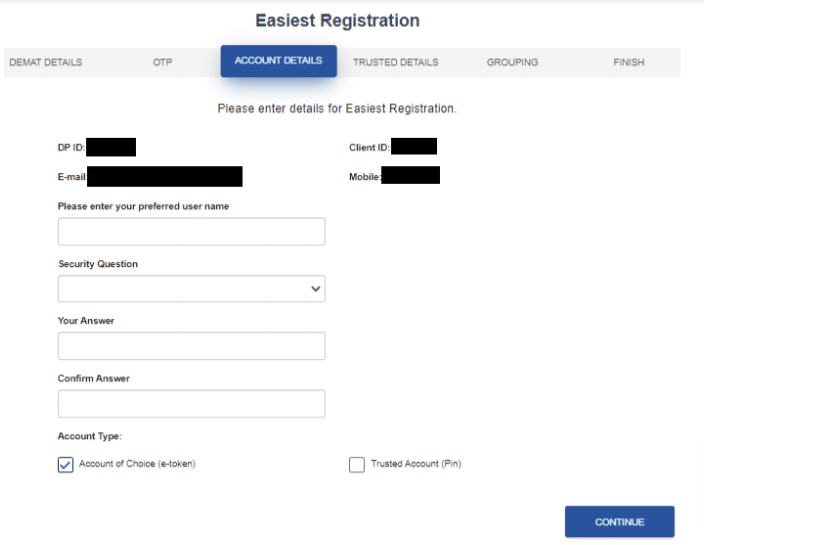

- After entering the OTP, you will be asked to answer a security question.

- Once the above details are filled in and click continue to proceed to the next step.

- Your broker should accept the easiest request that you have raised in order to transfer the shares to Paytm Money’s DEMAT account. Please reach out to your broker for the same.

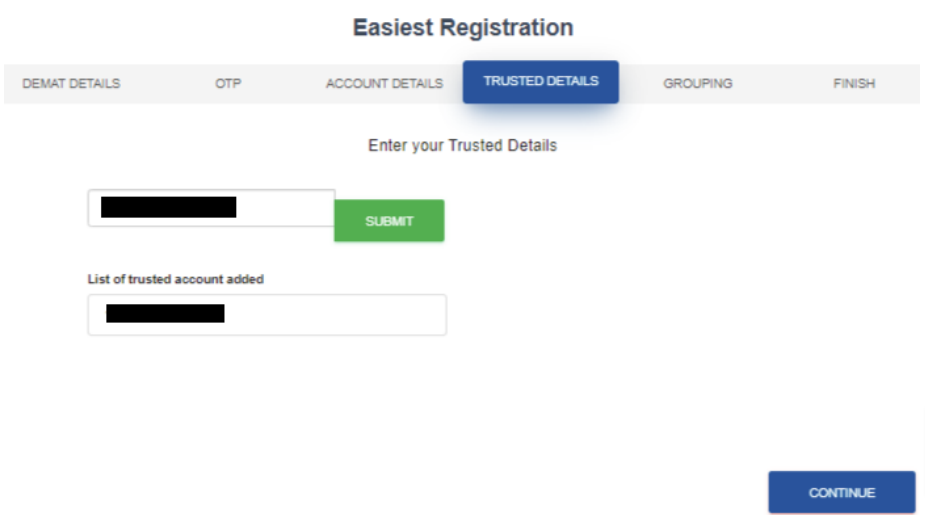

- Meanwhile, you need to add the ‘Trusted Details’ which is your Paytm Money’s Demat Account Number (A.K.A BO ID).

– You can click here to find your Demat Account Number.

– For adding this, you will get another OTP for confirmation

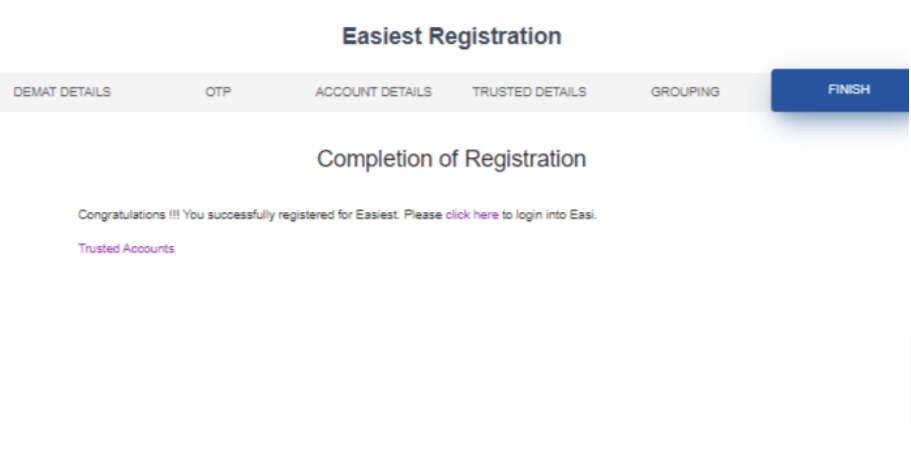

- After adding your trusted account, the registration will complete.

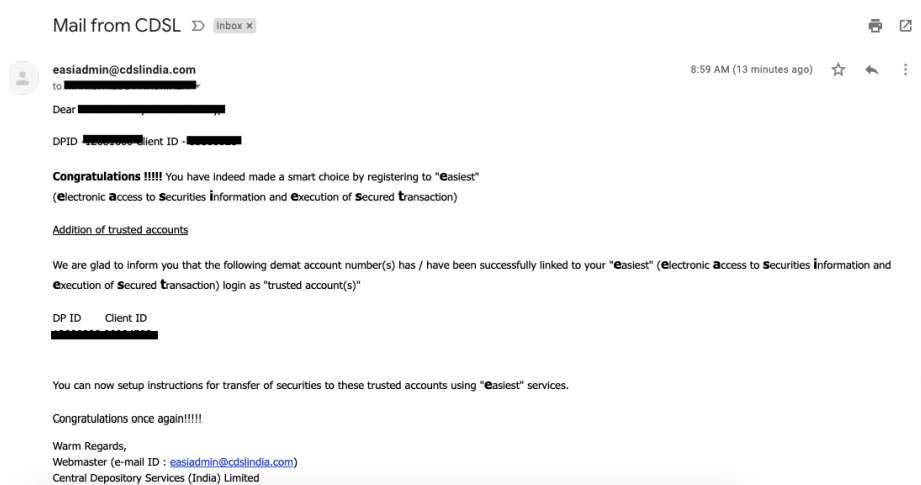

This completes the process of creating an account with CDSL easiest. You can transfer the shares. You have to wait for your broker to approve the Easiest request to go ahead and transfer the shares. Typically, it takes 24 Hrs for the broker to approve the request. You can check your email for updates from the CDSL post-approval. Post this you can proceed to transfer shares.

Now, let’s understand how we can transfer the required holdings from one DEMAT account to another.

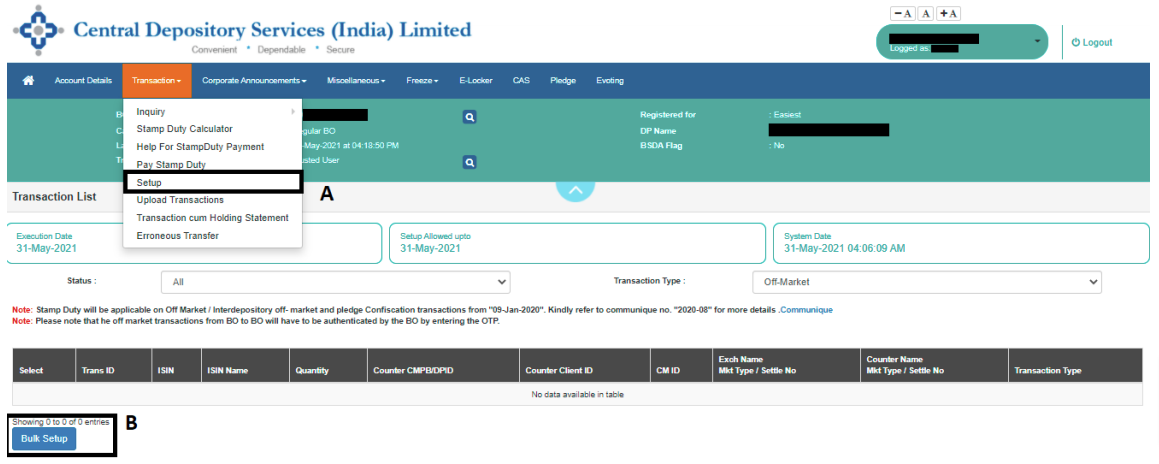

- After logging in to the CDSL easiest portal.

– Click on Transactions > Setup.

– And Bulk Setup to move further.

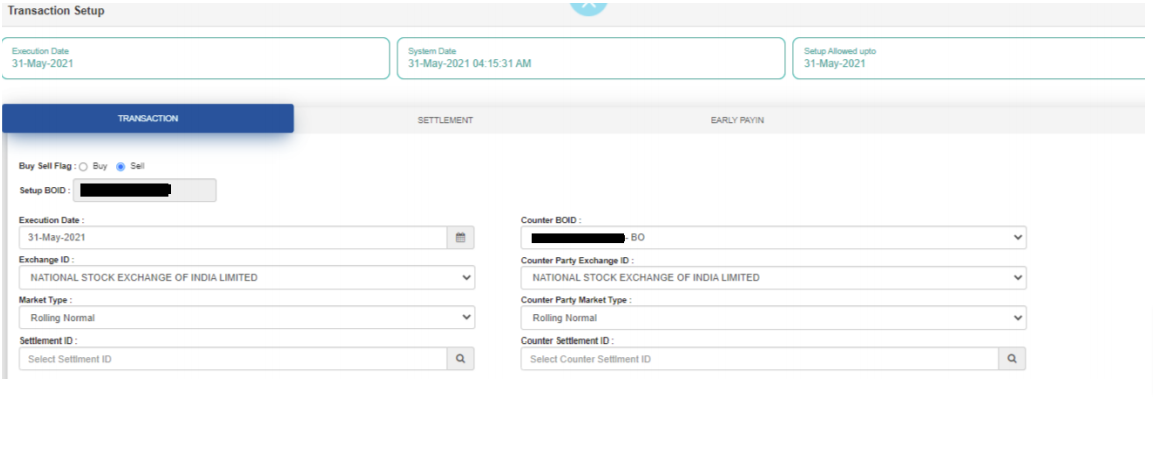

- You should fill in the necessary information as mentioned below.

- Select the NA option under Entity Identifier.

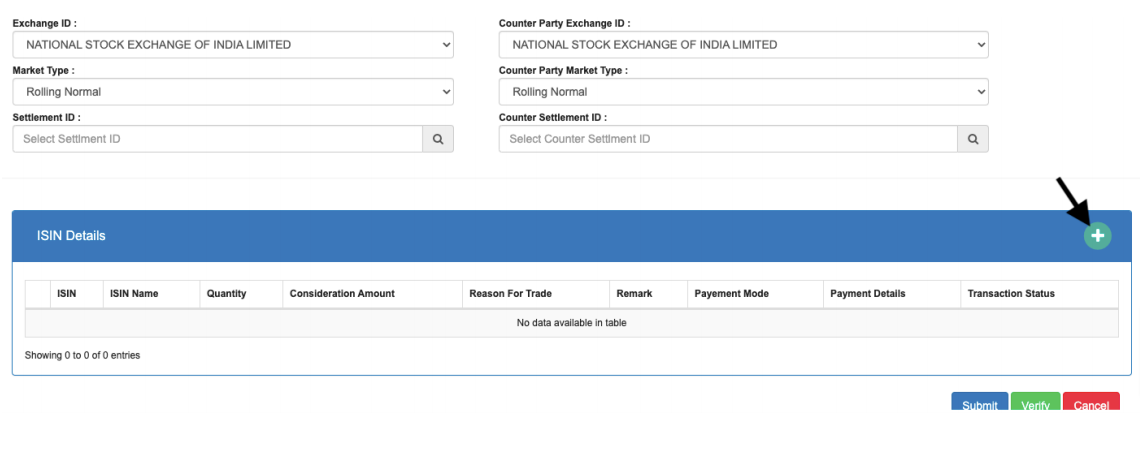

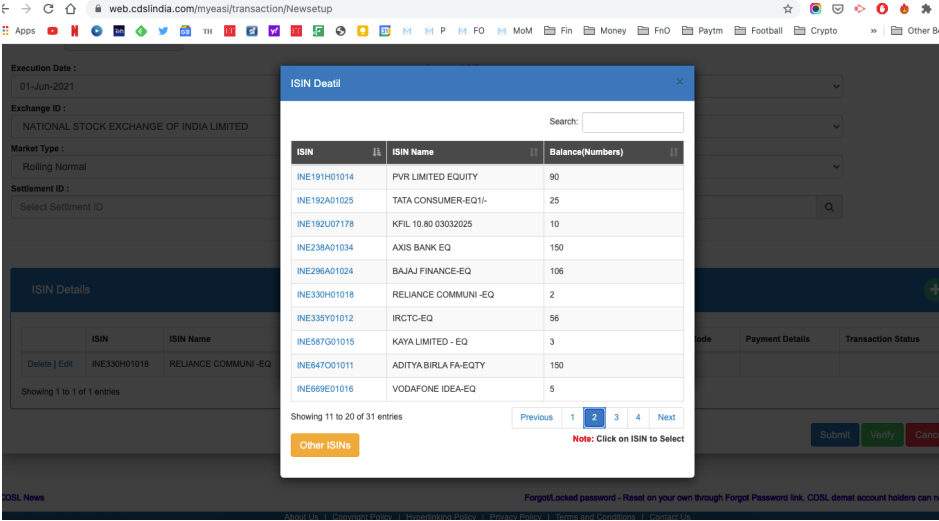

- Select the ISINs (Stocks) that you want to transfer one by one.

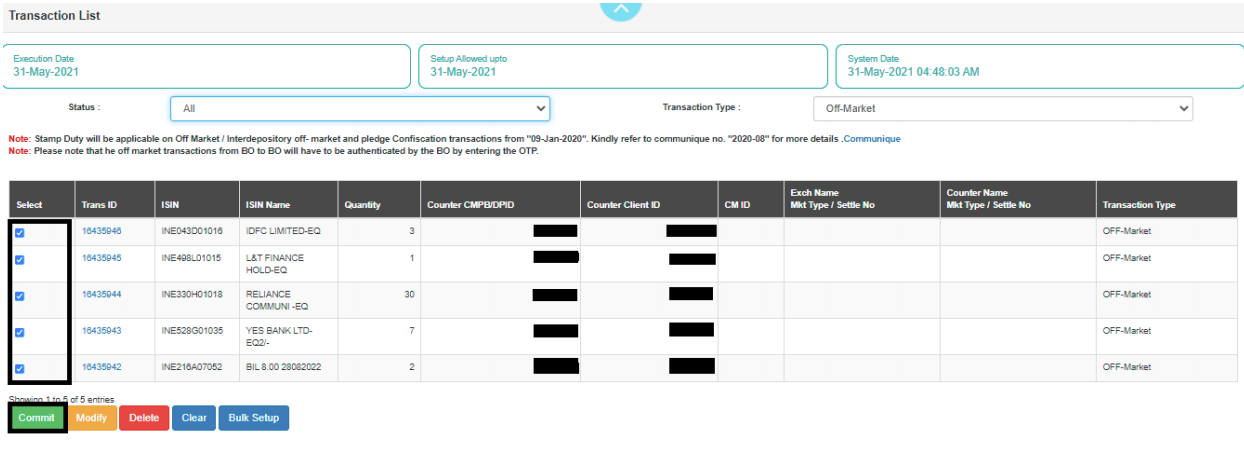

- When you’re done adding all the stocks that you want to move, select them and click on Commit, and you’ll get an OTP to your registered Phone number to verify the transactions.

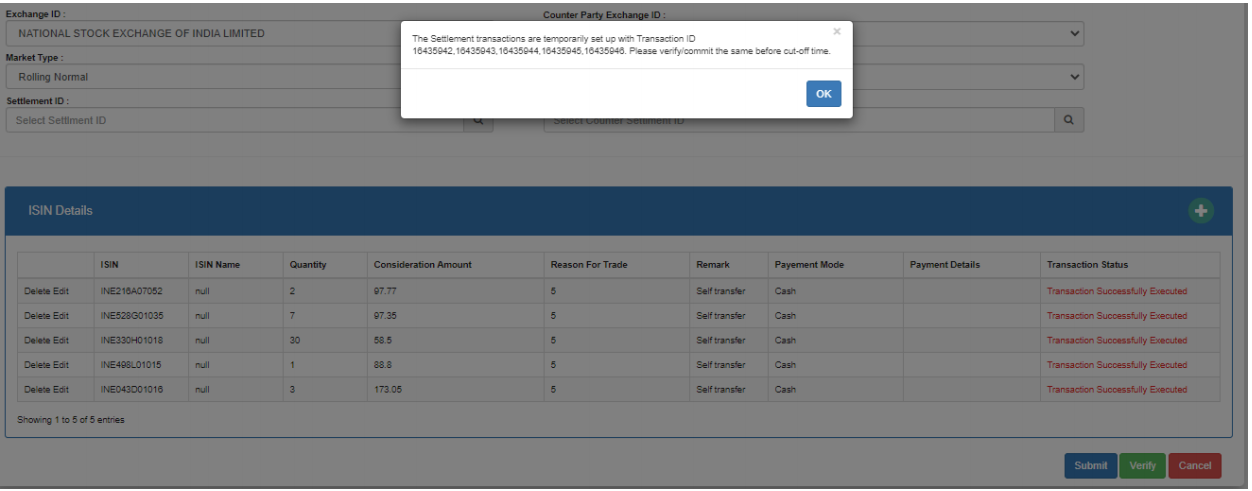

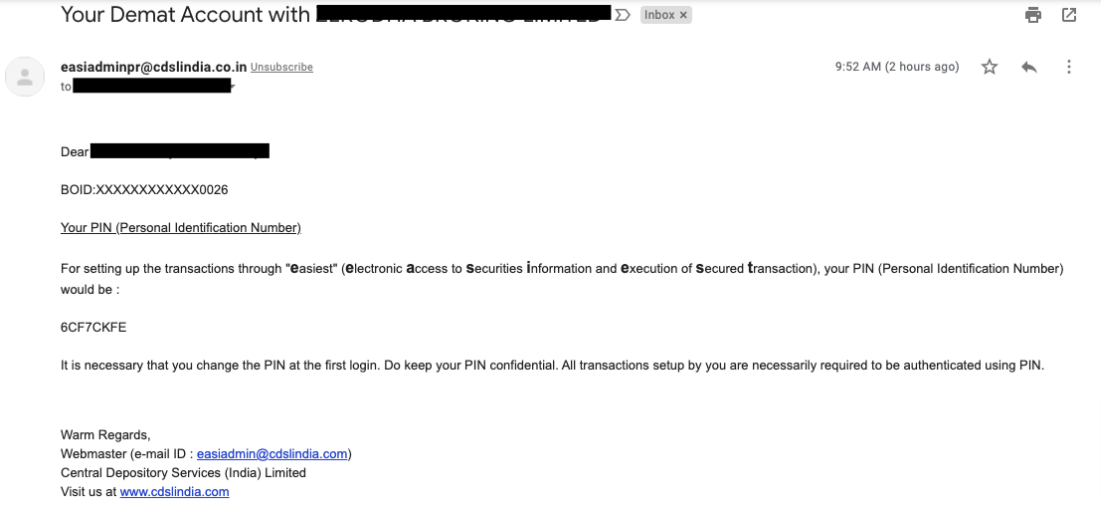

- Once OTP is authorized, you need to enter the PIN given the CDSL via Email. You need to reset the PIN by going to the Change PIN option.

- Once the PIN is entered, the request is considered accepted by CDSL. Your broker will receive the Off-Market transfer request and will authorize it within 24-48 Hrs. If your request is not authorized, please follow up with your Broker customer care.

Offline method (via DIS)

Many brokers currently support only the offline DIS process of transferring shares. This process is an offline process that has to be done in person by you. Your previous broker will take an offline share transfer request through a Delivery Instruction Slip (DIS) where you should fill the Paytm Money’s Demat account number and the stocks that you want to transfer.

- DIS (Delivery Instruction Slip), which is in a paper form, will be given to you by the previous broker (the Demat account you want to transfer shares from)

- Your previous broker may ask you for the CMR copy of Paytm Money, we have already shared it when you have opened your account. You can find the CMR document in your email inbox by searching for ‘CMR Paytm money’. In case you are not able to find it, please raise a request through the support portal.

- Fill the DIS booklet as your previous broker instructs with the 16 digits Paytm Money’s Demat account number and the list of shares you want to transfer.

- Your broker should transfer the shares within 24-48 working hours, if it’s not done then reach out to them.

After transferring the stocks, the investment values won’t show up in your portfolio, and you can update them by going through the below Blog.

Update the Average prices for the transferred stocks