Rajputana Stainless IPO Review: Key Details, Company Overview, Industry Context & Financials

Rajputana Stainless IPO is a book built issue worth ₹254.98 crore. The public issue consists of a fresh issue of 1.47 crore shares amounting to ₹178.73 crore and an offer...

Common SIP Investment Mistakes to Avoid for Better Mutual Fund Returns

A Systematic Investment Plan, or SIP, is a powerful investment method that allows you to make small, fixed contributions to mutual funds at regular intervals and build wealth over time....

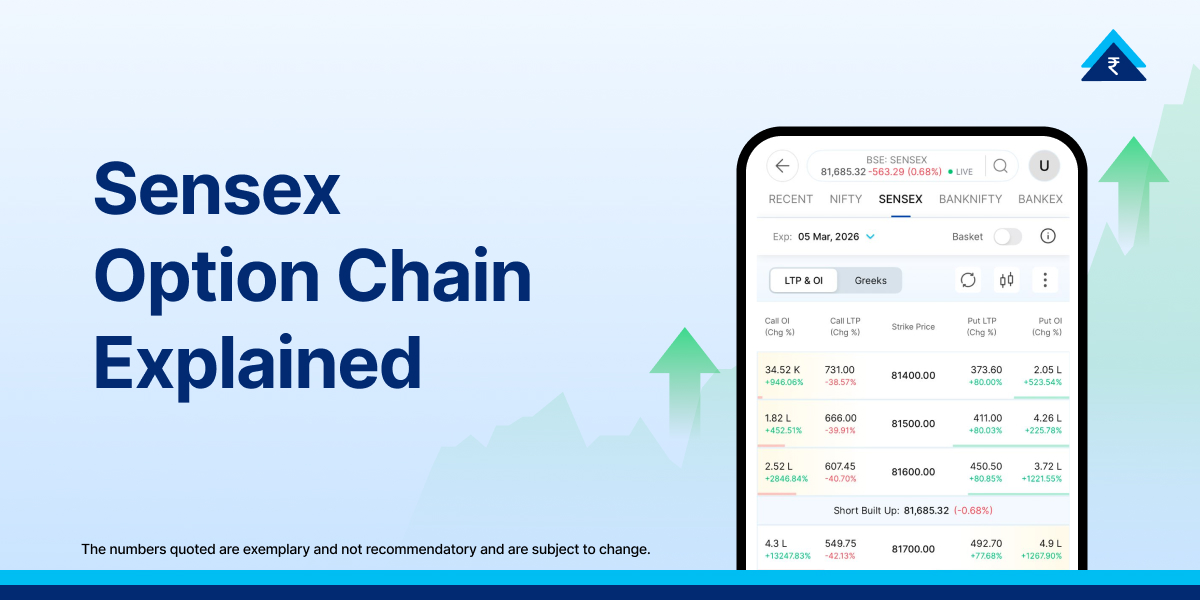

Sensex Option Chain: Meaning, Data & Trading Use Cases

For traders participating in index derivatives, understanding the Sensex option chain is essential. The option chain provides a structured view of available call and put contracts across different strike prices...

Option Chain Explained: Meaning, Data & How Traders Use It

For anyone trading derivatives, understanding the option chain is essential. It is one of the most widely used tools by options traders to analyse market positioning, liquidity, and strike-level activity....

BSE Option Chain Explained: How It Differs from NSE

For derivatives traders, understanding the BSE option chain is important when analysing index and stock options listed on the Bombay Stock Exchange. While many traders are familiar with NSE derivatives,...

₹10,000 in PPF vs SIP: Which Investment Gives Better Returns in 15 Years

For many individuals in India, the first serious investment decision begins with a familiar question. Should your money go into a safe government backed scheme, or should it be invested...

Silver ETFs vs Physical Silver: Which Is Better for Indian Investors

Have you ever walked past a jewellery store and felt that familiar pull towards the gleaming white metal in the window? In India, silver has always held a special place...

International Mutual Funds Explained: Your Guide to Investing Abroad

Have you ever wondered how you can invest in companies like Apple, Microsoft or global technology giants without opening a foreign trading account? You are not alone. Many Indian investors...

F&O Trading Basics With Examples

If you’re exploring derivatives for the first time, Understanding F&O Trading basics with examples is essential before placing your first trade. Futures & Options (F&O) allow traders to take positions...

Using MTF for Same-Day Trades vs Holding Longer: Which Works Better?

If you have been exploring the stock market on the Paytm Money app, you might have noticed a feature called MTF-Pay Later (Margin Trading Facility). It is a trading tool...

How to Build a ₹1 Lakh Monthly Retirement Pension: SIP Strategy for Salaried Professionals

To build a ₹1 lakh monthly pension in India starting at age 30, you need a target retirement corpus of approximately ₹3 crore in today’s value. This financial goal is...

SEDEMAC Mechatronics IPO Review: Key Details, Company Overview, Industry Context & Financials

SEDEMAC Mechatronics is launching a book-built IPO with a total issue size of ₹1,087.45 crore. The public offering is entirely an Offer for Sale (OFS) of 0.80 crore equity shares....