Apply to IPOs using UPI and Paytm Money Demat easily

Invest in your favourite companies from their beginning in stock markets.

Apply to IPOs using UPI and Paytm Money Demat easily

Invest in your favourite companies from their beginning in stock markets.

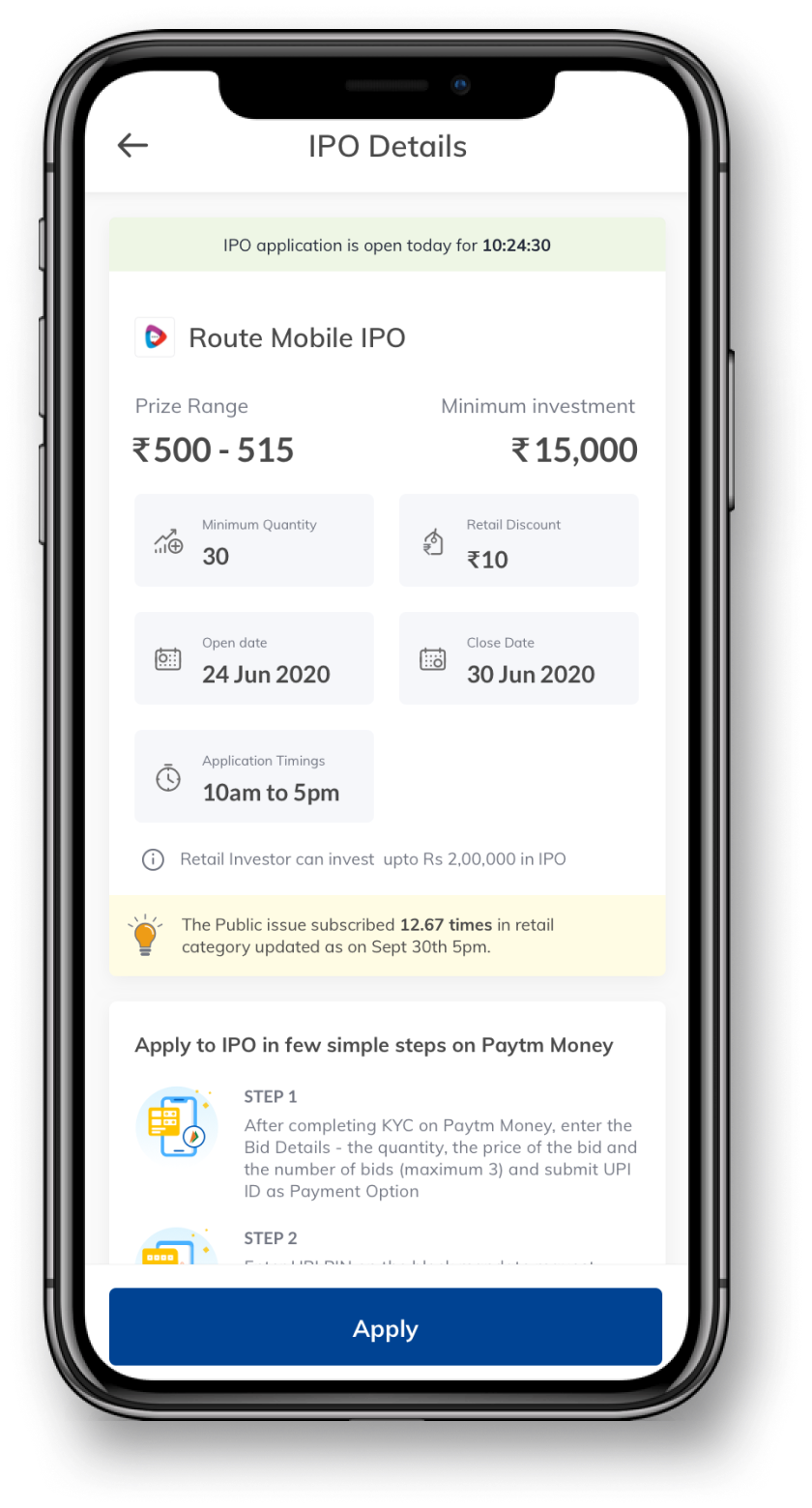

How to Apply for IPOs on Paytm Money

Once KYC is done, enter your bid details (quantity, price & no. of bids) and submit UPI ID.

Accept the “Block Funds” request on UPI app

If allotted, final amount will be debited otherwise, it will be unblocked.

The Bidding Process

- Applying for an IPO is easier than ever with Paytm Money, in just a few clicks your application is processed. You can bid for any IPO through Paytm, the bidding process is simple and hassle free. Every company has a lot size decided & you can buy in multiples of the decided lot.

- If lot size is 15, then you have to bid for multiples of 15 share like 30,45,60 and so on.

- The maximum subscription amount for retail investors is 2 lakh.

- Any bid can be at a desired price or cut off price given by the company.

How to bid on App

- Enter the number of shares you wish to buy, as per the lot size.

- You can apply at the cut off price set by the company or bid for a desired amount within the price band.

- Maximum three bids will be accepted.

- You then need to enter the UPI ID on Paytm Money’s IPO application form.

Investing using UPI

- You will immediately get a fund block request on your UPI for the submitted IPO application.

- The funds will be blocked in your bank account until allotment when it is debited.

- The limit for IPO application is Rs 2 lakh per transaction on UPI.

- On allotment of the shares, the money will be automatically debited.

- If the share aren’t allotted the blocked funds will reflect back into your account.

Frequently Asked Questions

What is an IPO?

The primary reason companies go public is to raise capital. When a private company decides to raise equity capital by offering its shares for sale to the public for the first time, it is known as a “going public” and the entire process of offering shares is called a “public offer”. To read more about IPOs Click Here.

What are the merits of investing in IPO?

If you invest in an IPO you get to be a part of the growth story of

that company because every company

has Capex plans from proceedings of

the IPO hence the

share price is likely to gain in the

future given the growth prospects.

Apart from that, the valuation you

get at the IPO is determined by

merchant bankers

after looking at the company’s

overall performance, but once the

shares are listed the

market determines the price of

shares.

How do I invest in an IPO?

Investing in an IPO via UPI is easy and hassle-free. You just have to complete your KYC process, create a Demat account if not created already and fill in the application for IPO i.e enter the lot size, bid amount, block funds in your bank account through UPI, and submit the application.

What documents do I need for an IPO application?

To apply for an IPO, you need to open a Demat account by submitting your Aadhar Card, Pan Card for KYC and once your Demat account is in place you can apply for an IPO with just a UPI Id.

What is the retail limit to apply for an IPO?

If you are applying through retail

quota, then the total limit is Rs. 2

lakhs, that

means including all the three bids

your amount that is frozen through

UPI for IPO should

not exceed Rs. 2 lakh. The blocked

amount is the highest of the three

bids.

For Instance, if your three bids for

IPO range of Rs. 295-305 are

Bid 1. 10 shares at Rs. 302

Bid 2. 150 shares at Rs. 301

Bid 3. 50 shares at the cut-off

Then the blocked amount will be

highest of 10*302 = 3020 ,150*301 =

45,150, 50*305 =

15250 which is Rs. 45,150, and this

blocked amount should not exceed Rs.

2 lakhs.

Can I apply for an IPO through Paytm Money?

Yes, you can apply for an IPO through the Paytm Money app. All you have to do is complete your KYC, submit bids and block your funds (to be used for payment in case you get the allotment) by entering your UPI Id.

Will I need a Demat account of Paytm Money to invest in IPO?

Yes, if you are applying for an IPO through Paytm Money you will need a Demat account with us.

What does Paytm Money charge if I apply for an IPO?

Paytm Money does not charge any brokerage or additional fees for IPOs. With no hidden charges in the app our pricing is fully transperent.

Where do I search for upcoming IPOs?

On the IPO dashboard you will find the list of upcoming and past IPO, where you can also find more details like expected open date, price band if announced and so on.

How can I look at past IPOs performance?

Once you go on the IPO dashboard on

Paytm Money app, you can click on

any past IPO and

look at the performance like listing

day gains, cut-off price,

subscription data and so

on.

For instance, if you want to look at

Route Mobile’s performance, you can

scroll down and

search for Route Moblie’s IPO and

click on it to find all the data you

need for

analysis.

How to place bids for IPO?

Once you go on the IPO dashboard on

Once an IPO opens for bidding, you

can enter all the details and place

three bis for one

application.

For instance, if the range of an IPO

of Rs. 295-305, then you can place

three bids

between this price range or cut-off

price which is decided later at the

time of

allotment.

Bid 1 - 50 shares at Rs. 297

Bid 2 - 70 shares at cut off

Bid 3 - 100 shares at Rs. 300

At the time of allotment, in the

case the issue price is above Rs.

300 then you will be

eligible for only bid 2, and if the

issue price is Rs. 300, you will get

allotment for

Bid 2 and Bid 3. In case when the

issue price is Rs 295 then you will

be eligible for

allotment of all three bids. Click

Here. to Read About How to Apply For

IPOs.

What is a Cut Off Price

The actual discovered issue price can be any price in the price band or any price above the floor price and hence the issue price is coined as the “Cut off price”. To read More About Cut Off Price Click Here.

Can I place multiple bids for an IPO?

Yes, you can place multiple bids but

a maximum of three bids are allowed

through one

Demat account.

For example: If the IPO price range

is Rs. 95-105, then you can place

three bids for any

amount varying from Rs. 95-105.

How will I know if my application has been submitted at the exchange successfully?

When you complete the process and accept the mandate through UPI app, the status of your application will change from “Application Pending” to “Application Successful”, that’s when your bid will be submitted to the exchange successfully.