NAV

₹183.5770

as on 11 Apr 2025, 11:12 PM

₹3.1270(1.73%)

Last Change

Scheme Ratings

5

rated by Value Research

Mid Cap

Rankings based on | as on Invalid date

×

Investment Performance

would have given a return of

₹1,10,871

₹1,21,647

₹1,76,535

₹1,80,126

Bank Account

Fixed Deposit

Regular Mutual Fund

This Fund on Paytm Money

This Mutual Fund

₹80,126

Profit (absolute return)

80.13%

in the last

1m

3m

1y

3y

5y

max

+1% Higher Returns

With Direct Plans on Paytm MoneyInvestment Returns

In the last 3 months

8.47%

In the last 6 months

12.40%

In the last 1 year

3.16%

In the last 3 years

80.13%

In the last 5 years

322.93%

In the last 10 years

369.72%

Absolute Returns

CAGR

Scheme Riskometer

low

low to moderate

moderate

moderately high

high

very high

Investors understand that their principal will be at very high risk

Scheme Information

HDFC Mid-Cap Opportunities Direct Plan-Growth

as of 31 Mar 2025, 05:30 AM

₹72,610.08 Cr

Scheme Asset Size

Fund Type

Open-End

Exit Load

Exit load of 1% if redeemed within 1 year.

0.89%

Expense Ratio

Plan

Growth

Benchmark

NIFTY Midcap 150 Total Return Index

Exit Load

Exit load of 1% if redeemed within 1 year.

Scheme Document

Sectors Holding in this Mutual Fund

as on 31 Mar 2025

Financial

21.63%

₹15,705.56 Cr

Healthcare

12.27%

₹8,909.26 Cr

Services

9.61%

₹6,977.83 Cr

Automobile

8.78%

₹6,375.16 Cr

Technology

8.40%

₹6,099.25 Cr

Others

39.31%

₹28,543.02 Cr

View All

View All

Companies Holding in this Mutual Fund

as on 31 Mar 2025

The Indian Hotels Company Ltd.

4.12%

₹2,991.54 Cr

Apollo Tyres Ltd.

3.22%

₹2,338.04 Cr

Max Financial Services Ltd.

3.20%

₹2,323.52 Cr

The Federal Bank Ltd.

3.11%

₹2,258.17 Cr

Others

86.35%

₹62,698.80 Cr

View All

View All

This fund's returns:

21.65%Return Duration

3 Years

Motilal Oswal Midcap Fund Direct-Growth

EquityMid Cap

Min. Investment

₹100

Category Returns

10.77%

24.20%

3Y Returns

24.20

ITI Mid Cap Fund Direct - Growth

EquityMid Cap

Min. Investment

₹500

Category Returns

10.77%

24.20%

3Y Returns

21.02

Nippon India Growth Fund Direct- Growth

EquityMid Cap

Min. Investment

₹100

Category Returns

10.77%

24.20%

3Y Returns

21.00

About HDFC Mid-Cap Opportunities Direct Plan-Growth

HDFC Mid-Cap Opportunities Direct Plan-Growth is a Equity mutual fund scheme from HDFC Mutual Fund. This scheme was launched on Invalid date. It has an AUM of ₹72,610.08 Crores and the latest NAV decalared is ₹183.577 as on 13 Apr 2025 at 6:53 am.

HDFC Mid-Cap Opportunities Direct Plan-Growth scheme return performance in last 1 year is 3.16%, in last 3 years is 80.13% and 876.53% since scheme launch. The min. SIP amount to invest in this scheme is ₹100.

Scheme Details

| AUM: | ₹72,610.08 Cr |

| Category: | Equity: Mid Cap |

| Launch Date: | Invalid date |

| Fund Type: | Open-End |

AMC Information

HDFC Mutual Fund

View AMC Details

₹7,62,037.70 Cr

AUM

161

Schemes

Address

"HDFC House", 2nd Floor, H. T. Parekh Marg, 165-166, BackbayReclamation, Churchgate400020

Phone Number

Phone : 022 – 66316333

Fax : 022 – 66580203

Email / Website

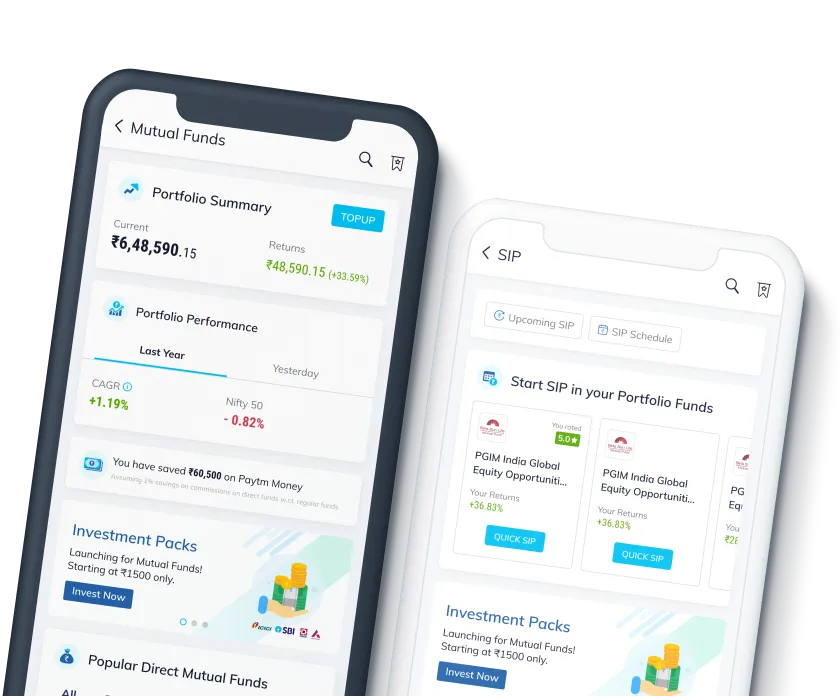

Start investing in minutes

Download app to Explore

Scan this QR code to download the app now!

Or download from